Summary

Financial exchanges have recently shown an interest in migrating to the public cloud for scalability, elasticity, and cost savings. However, financial exchanges often have strict network requirements that can be difficult to meet on the cloud. Notably, market participants (MPs) trade based on market data about different activities in the market. Exchanges often use switch multicast to disseminate market data to MPs. However, if one MP receives market data earlier than another, that MP would have an unfair advantage. To prevent this, financial exchanges often equalize exchange-to-MP cable lengths to provide near-simultaneous reception of market data at MPs. As a cloud tenant, however, building a fair multicast service is challenging because of the lack of switch support for multicast, high latency variance, and the lack of native mechanisms for simultaneous data delivery in the cloud. Jasper introduces a solution that creates an overlay multicast tree within a cloud region that minimizes latency and latency variations through hedging, leverages recent advancements in clock synchronization to achieve simultaneous delivery, and addresses various sources of latency through an optimized DPDK/eBPF implementation -- while scaling to a thousand receivers. Jasper outperforms a prior system, CloudEx, and a commercial multicast solution provided by Amazon Web Services. We present different deployment models and their performance impact. A deployment model where MPs and the exchange do not have to trust each other is realized using confidential computing.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research employs a systematic approach to optimize both inbound (orders submission) and outbound (market data delivery) workflows of an exchange system, utilizing an overlay multicast tree within a cloud region for minimizing latency and latency variations.

Key Results

- Jasper outperforms prior systems CloudEx and a commercial multicast solution provided by Amazon Web Services in terms of fairness, throughput, and latency.

- Jasper can scale to support 1000 receivers and potentially more, maintaining graceful latency growth as the number of receivers increases.

- Jasper's use of proxy hedging reduces overall multicast latency, with hedging factor H=1 showing the most significant improvement.

- Round Robin Packet Spraying (RRPS) improves multicast latency by approximately 10% on GCP and up to 70% on AWS, especially during message bursts.

- Receiver heding improves overall multicast latency and achieves fairness, with DWS ≤ 1µs at 99.9% probability when using hold-and-release.

Significance

This research is significant as it introduces Jasper, a networking support system for scalable financial exchanges in the cloud, addressing strict network requirements while providing scalability, elasticity, and cost savings.

Technical Contribution

Jasper introduces an overlay multicast tree within a cloud region, leveraging clock synchronization advancements, optimized DPDK/eBPF implementation, and confidential computing for near-simultaneous delivery without trust between market participants and the exchange.

Novelty

Jasper's novelty lies in its approach to creating a scalable and fair multicast service in the cloud, addressing challenges such as lack of switch support for multicast, high latency variance, and the absence of native mechanisms for simultaneous data delivery.

Limitations

- The study does not compare Jasper with DBO, as DBO changes the definition of fairness to not rely on simultaneous delivery.

- The evaluation is conducted primarily on AWS and GCP, so results might not generalize to other cloud platforms.

Future Work

- Explore the integration of Jasper with other cloud services for broader applicability.

- Investigate the impact of Jasper on different types of financial exchanges beyond the scope of this research.

Paper Details

PDF Preview

Key Terms

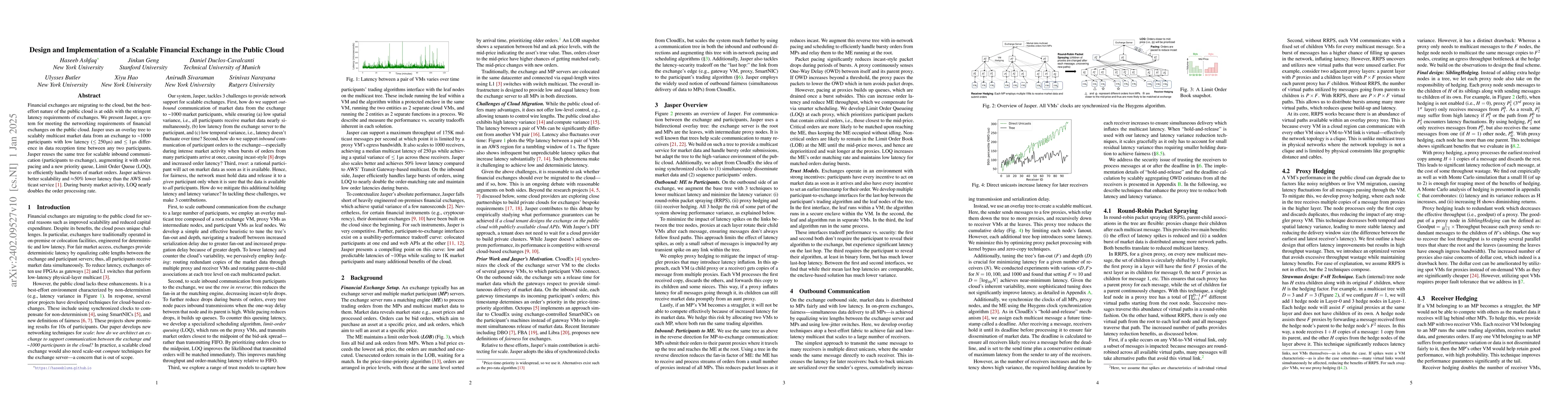

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDBO: Response Time Fairness for Cloud-Hosted Financial Exchanges

Prateesh Goyal, Ilias Marinos, Ranveer Chandra et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)