Summary

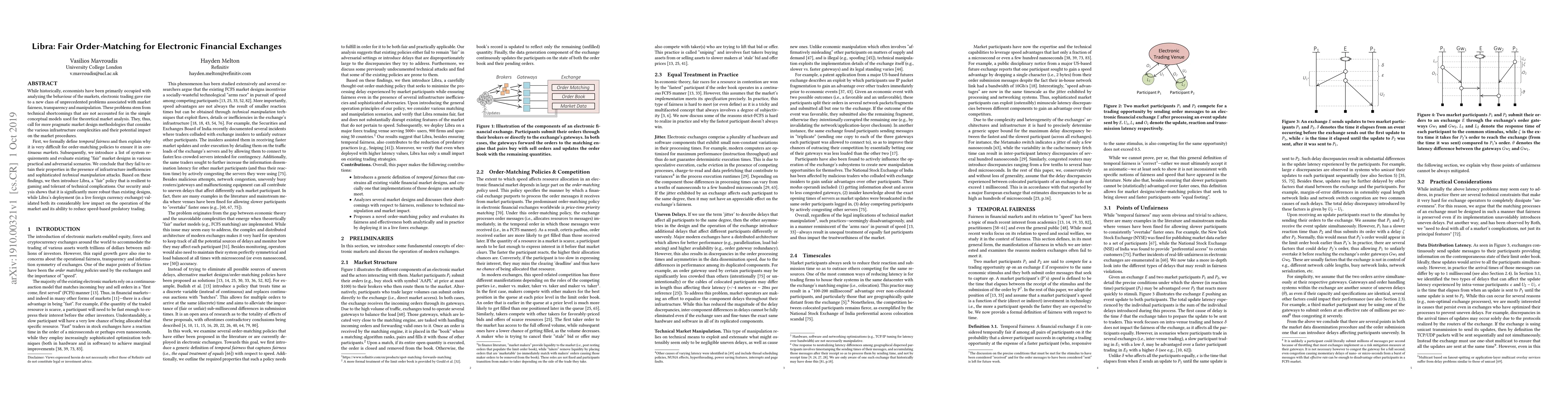

While historically, economists have been primarily occupied with analyzing the behaviour of the markets, electronic trading gave rise to a new class of unprecedented problems associated with market fairness, transparency and manipulation. These problems stem from technical shortcomings that are not accounted for in the simple conceptual models used for theoretical market analysis. They, thus, call for more pragmatic market design methodologies that consider the various infrastructure complexities and their potential impact on the market procedures. First, we formally define temporal fairness and then explain why it is very difficult for order-matching policies to ensure it in continuous markets. Subsequently, we introduce a list of system requirements and evaluate existing "fair" market designs in various practical and adversarial scenarios. We conclude that they fail to retain their properties in the presence of infrastructure inefficiencies and sophisticated technical manipulation attacks. Based on these findings, we then introduce Libra, a "fair" policy that is resilient to gaming and tolerant of technical complications. Our security analysis shows that it is significantly more robust than existing designs, while Libra's deployment (in a live foreign currency exchange) validated both its considerably low impact on the operation of the market and its ability to reduce speed-based predatory trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDBO: Response Time Fairness for Cloud-Hosted Financial Exchanges

Prateesh Goyal, Ilias Marinos, Ranveer Chandra et al.

Reachability of Fair Allocations via Sequential Exchanges

Warut Suksompong, Sheung Man Yuen, Ayumi Igarashi et al.

Automatic Fair Exchanges

Lorenzo Ceragioli, Pierpaolo Degano, Letterio Galletta et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)