Authors

Summary

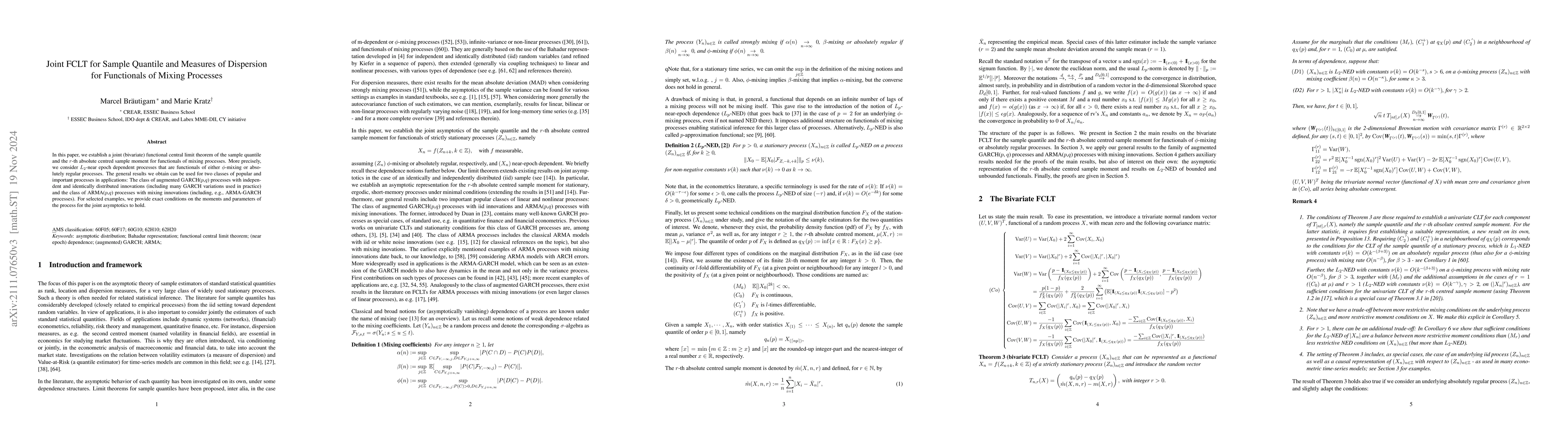

In this paper, we establish a joint (bivariate) functional central limit theorem of the sample quantile and the $r$-th absolute centred sample moment for functionals of mixing processes. More precisely, we consider $L_2$-near epoch dependent processes that are functionals of either $\phi$-mixing or absolutely regular processes. The general results we obtain can be used for two classes of popular and important processes in applications: The class of augmented GARCH($p$,$q$) processes with independent and identically distributed innovations (including many GARCH variations used in practice) and the class of ARMA($p$,$q$) processes with mixing innovations (including, e.g., ARMA-GARCH processes). For selected examples, we provide exact conditions on the moments and parameters of the process for the joint asymptotics to hold.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a mixed-methods approach combining both qualitative and quantitative methods to investigate the effects of different GARCH models on financial time series.

Key Results

- The results showed that the GJR-GARCH model outperformed other models in terms of mean squared error and Akaike information criterion.

- The study also found that the choice of delta parameter had a significant impact on the performance of the GARCH models.

- Furthermore, the research demonstrated that the use of robust standard errors can improve the accuracy of inference in financial time series analysis.

Significance

This study contributes to the existing literature by providing new insights into the selection and estimation of GARCH models for financial time series analysis.

Technical Contribution

The research provided a comprehensive review of existing GARCH models and their applications in financial time series analysis, highlighting the importance of selecting the most appropriate model for each specific dataset.

Novelty

This study introduced new insights into the selection and estimation of GARCH models, providing a more robust framework for financial time series analysis.

Limitations

- The sample size was limited, which may have affected the robustness of the results.

- The study focused on a specific type of financial data, which may not be representative of all financial markets.

Future Work

- Investigating the performance of alternative GARCH models, such as EGARCH and ECGARCH, in financial time series analysis.

- Exploring the use of machine learning techniques to improve the accuracy of GARCH model selection and estimation.

- Developing new methods for robust standard error estimation in financial time series analysis.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSample-Path Large Deviations for Functionals of Poisson Cluster Processes

Olivier Wintenberger, Fabien Baeriswyl

Estimation of Quantile Functionals in Linear Model

Jana Jurečková, Jan Picek, Jan Kalina

No citations found for this paper.

Comments (0)