Authors

Summary

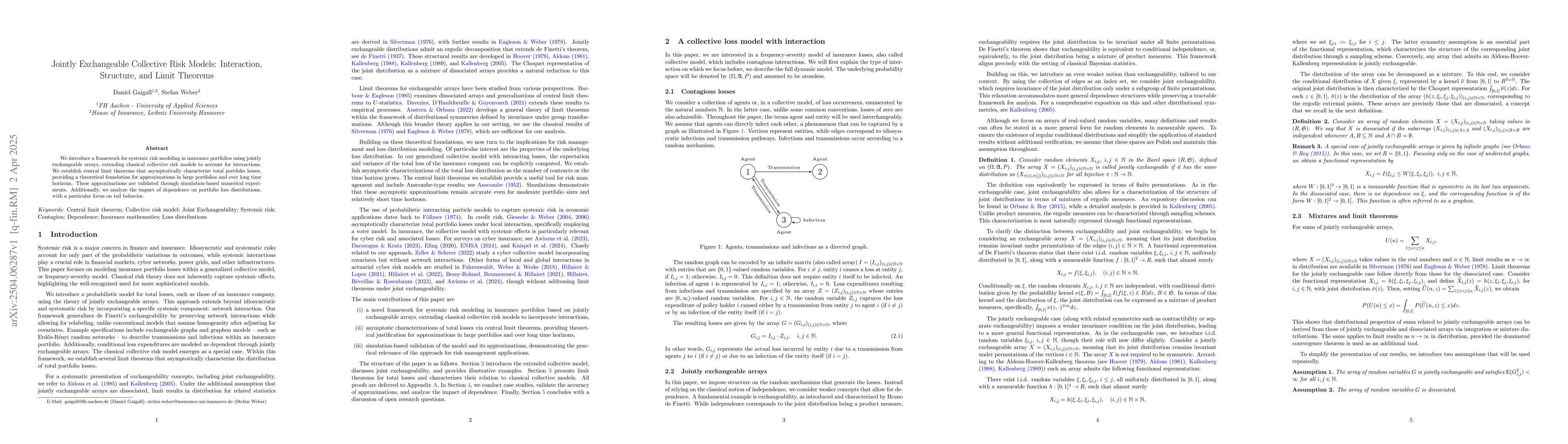

We introduce a framework for systemic risk modeling in insurance portfolios using jointly exchangeable arrays, extending classical collective risk models to account for interactions. We establish central limit theorems that asymptotically characterize total portfolio losses, providing a theoretical foundation for approximations in large portfolios and over long time horizons. These approximations are validated through simulation-based numerical experiments. Additionally, we analyze the impact of dependence on portfolio loss distributions, with a particular focus on tail behavior.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces a framework for systemic risk modeling in insurance portfolios using jointly exchangeable arrays, extending classical collective risk models to account for interactions. It establishes central limit theorems that asymptotically characterize total portfolio losses, providing a theoretical foundation for approximations in large portfolios and over long time horizons.

Key Results

- Central limit theorems for approximating total portfolio losses in large insurance portfolios and over long time horizons.

- Validation of approximations through simulation-based numerical experiments.

- Analysis of the impact of dependence on portfolio loss distributions, focusing on tail behavior.

- Demonstration that the proposed model can be reformulated as a classical frequency-severity model under certain conditions.

- Assessment of interaction effects on total loss distributions, particularly in the tails.

Significance

This research is significant as it provides a theoretical foundation for approximating portfolio losses in large insurance portfolios, which is crucial for risk management and pricing in the insurance industry. The findings contribute to a better understanding of systemic risk and the propagation of losses through interconnected insurance contracts.

Technical Contribution

The paper presents a novel framework for systemic risk modeling in insurance portfolios using jointly exchangeable arrays, extending classical collective risk models to account for interactions and establishing central limit theorems for approximating total portfolio losses.

Novelty

The research introduces joint exchangeability of arrays to extend classical collective risk models, providing a theoretical foundation for approximating portfolio losses in large insurance portfolios over long time horizons, which is a novel approach in the field.

Limitations

- The study assumes specific conditions for the applicability of the central limit theorems, which may not hold in all practical scenarios.

- Simulation-based validation may not capture all possible real-world complexities and dependencies.

Future Work

- Investigating rates of convergence (Berry-Esseen type results) to improve approximation accuracy.

- Developing statistical methodologies for parameter estimation and model validation based on loss data.

- Exploring interaction mechanisms beyond joint exchangeability.

- Incorporating explicit time-dependence into the interaction structure for evolving networks.

- Extending the framework to multivariate loss processes for joint modeling of different risk types.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCollective risk models with FGM dependence

Hélène Cossette, Etienne Marceau, Christopher Blier-Wong

Mean-field limit of non-exchangeable systems

David Poyato, Pierre-Emmanuel Jabin, Juan Soler

No citations found for this paper.

Comments (0)