Authors

Summary

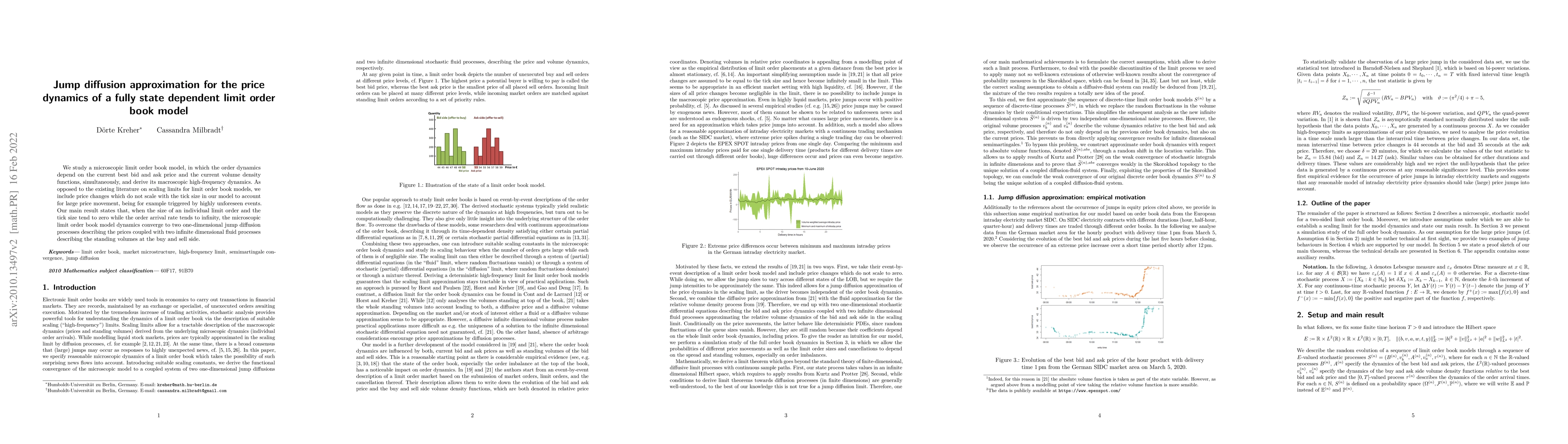

We study a microscopic limit order book model, in which the order dynamics depend on the current best bid and ask price and the current volume density functions, simultaneously, and derive its macroscopic high-frequency dynamics. As opposed to the existing literature on scaling limits for limit order book models, we include price changes which do not scale with the tick size in our model to account for large price movement, being for example triggered by highly unforeseen events. Our main result states that, when the size of an individual limit order and the tick size tend to zero while the order arrival rate tends to infinity, the microscopic limit order book model dynamics converge to two one-dimensional jump diffusion processes describing the prices coupled with two infinite dimensional fluid processes describing the standing volumes at the buy and sell side.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)