Authors

Summary

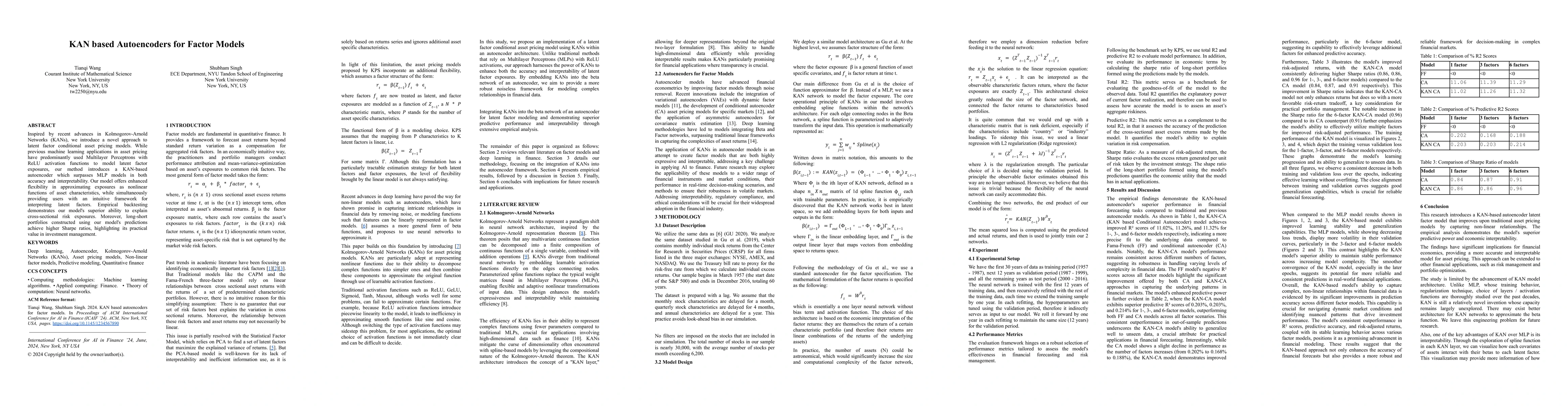

Inspired by recent advances in Kolmogorov-Arnold Networks (KANs), we introduce a novel approach to latent factor conditional asset pricing models. While previous machine learning applications in asset pricing have predominantly used Multilayer Perceptrons with ReLU activation functions to model latent factor exposures, our method introduces a KAN-based autoencoder which surpasses MLP models in both accuracy and interpretability. Our model offers enhanced flexibility in approximating exposures as nonlinear functions of asset characteristics, while simultaneously providing users with an intuitive framework for interpreting latent factors. Empirical backtesting demonstrates our model's superior ability to explain cross-sectional risk exposures. Moreover, long-short portfolios constructed using our model's predictions achieve higher Sharpe ratios, highlighting its practical value in investment management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKAN4TSF: Are KAN and KAN-based models Effective for Time Series Forecasting?

Xiao Han, Xinfeng Zhang, Zhe Wu et al.

HiPPO-KAN: Efficient KAN Model for Time Series Analysis

Jin-Kwang Kim, SangJong Lee, JunHo Kim et al.

STORM: A Spatio-Temporal Factor Model Based on Dual Vector Quantized Variational Autoencoders for Financial Trading

Yong Jiang, Wentao Zhang, Fei Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)