Summary

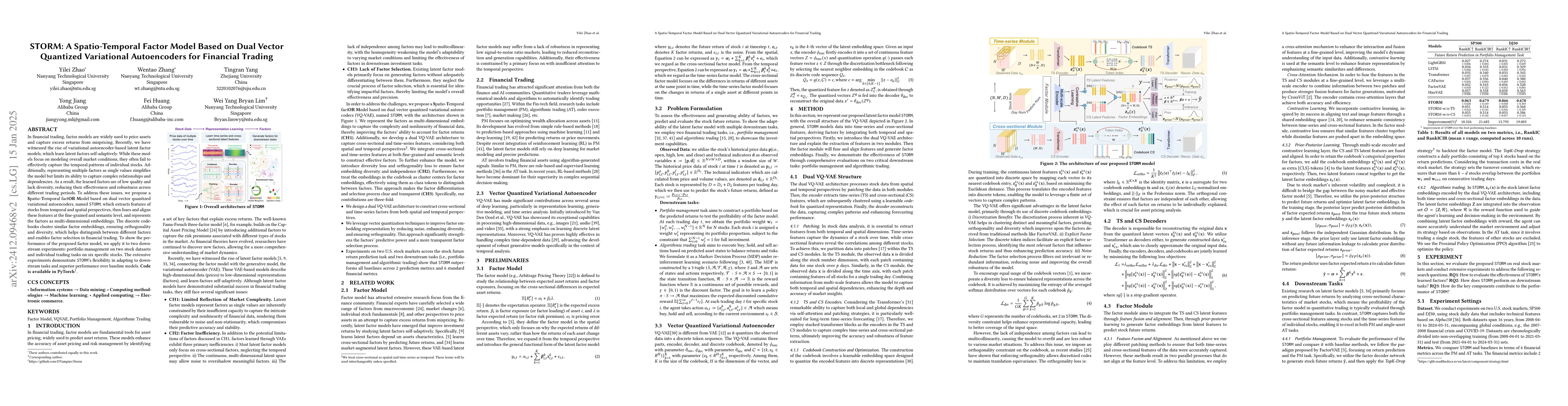

In financial trading, factor models are widely used to price assets and capture excess returns from mispricing. Recently, we have witnessed the rise of variational autoencoder-based latent factor models, which learn latent factors self-adaptively. While these models focus on modeling overall market conditions, they often fail to effectively capture the temporal patterns of individual stocks. Additionally, representing multiple factors as single values simplifies the model but limits its ability to capture complex relationships and dependencies. As a result, the learned factors are of low quality and lack diversity, reducing their effectiveness and robustness across different trading periods. To address these issues, we propose a Spatio-Temporal factOR Model based on dual vector quantized variational autoencoders, named STORM, which extracts features of stocks from temporal and spatial perspectives, then fuses and aligns these features at the fine-grained and semantic level, and represents the factors as multi-dimensional embeddings. The discrete codebooks cluster similar factor embeddings, ensuring orthogonality and diversity, which helps distinguish between different factors and enables factor selection in financial trading. To show the performance of the proposed factor model, we apply it to two downstream experiments: portfolio management on two stock datasets and individual trading tasks on six specific stocks. The extensive experiments demonstrate STORM's flexibility in adapting to downstream tasks and superior performance over baseline models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDiffusion bridges vector quantized Variational AutoEncoders

Eric Moulines, Sylvain Le Corff, Max Cohen et al.

STORM: Spatio-Temporal Reconstruction Model for Large-Scale Outdoor Scenes

Marco Pavone, Yue Wang, Yan Wang et al.

Modelling multivariate spatio-temporal data with identifiable variational autoencoders

Klaus Nordhausen, Mika Sipilä, Sara Taskinen et al.

No citations found for this paper.

Comments (0)