Authors

Summary

Spectral risk measures (SRMs) belong to the family of coherent risk measures. A natural estimator for the class of SRMs has the form of L-statistics. Various authors have studied and derived the asymptotic properties of the empirical estimator of SRM. We propose a kernel based estimator of SRM. We investigate the large sample properties of general L-statistics based on i.i.d and dependent observations and apply them to our estimator. We prove that it is strongly consistent and asymptotically normal. We compare the finite sample performance of our proposed kernel estimator with that of several existing estimators for different SRMs using Monte Carlo simulation. We observe that our proposed kernel estimator outperforms all the estimators. Based on our simulation study we have estimated the exponential SRM of four future indices-that is Nikkei 225, Dax, FTSE 100, and Hang Seng. We also discuss the use of SRM in setting initial margin requirements of clearinghouses. Finally we perform a backtesting exercise of SRM.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

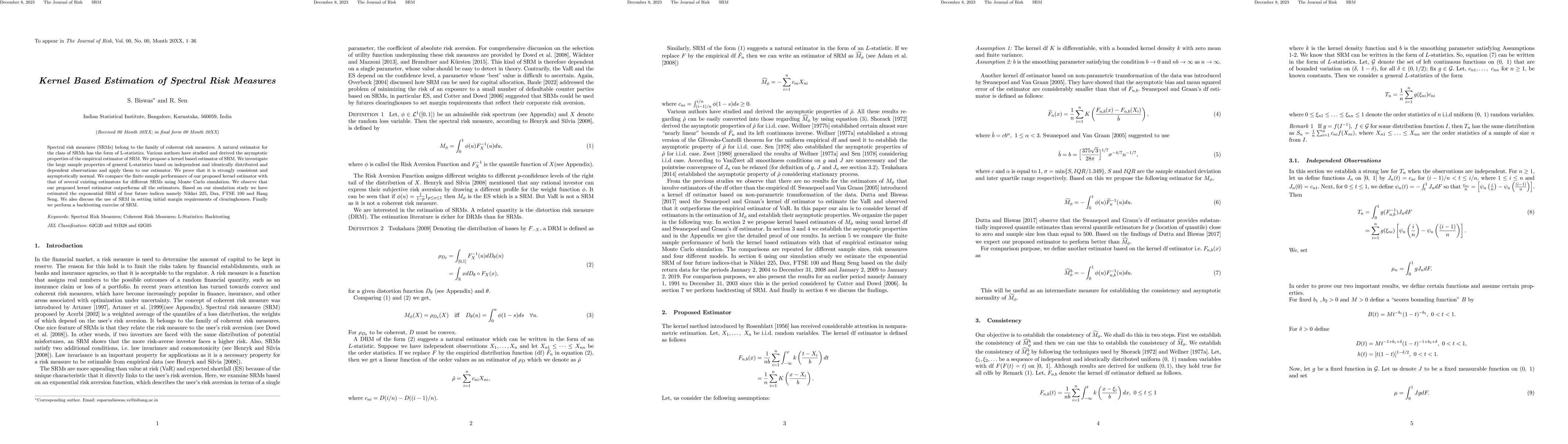

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCoherent estimation of risk measures

Igor Cialenco, Marcin Pitera, Damian Jelito et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)