Authors

Summary

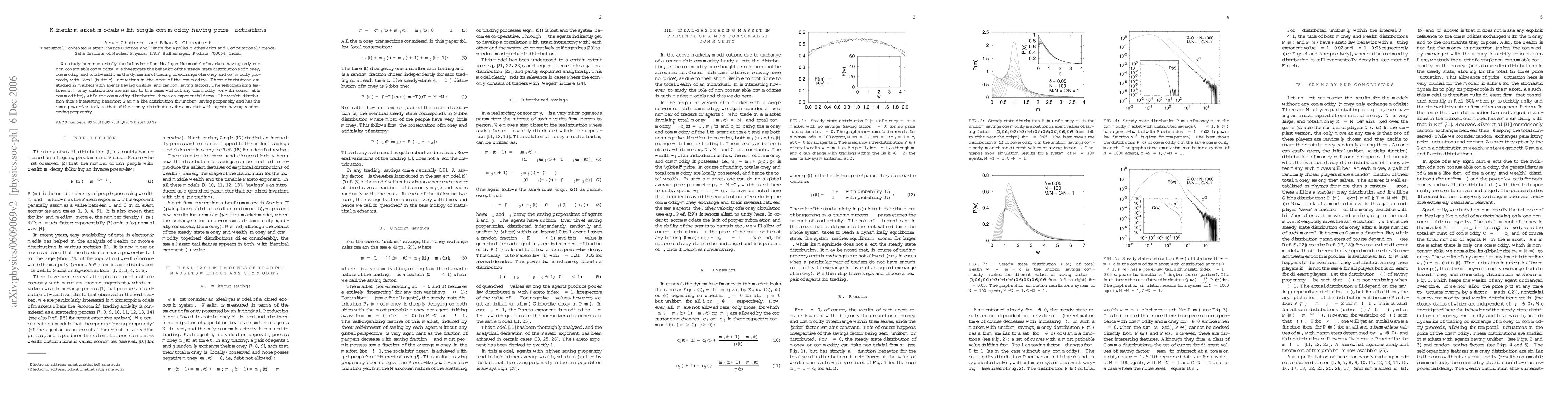

We study here numerically the behavior of an ideal gas like model of markets having only one non-consumable commodity. We investigate the behavior of the steady-state distributions of money, commodity and total wealth, as the dynamics of trading or exchange of money and commodity proceeds, with local (in time) fluctuations in the price of the commodity. These distributions are studied in markets with agents having uniform and random saving factors. The self-organizing features in money distribution are similar to the cases without any commodity (or with consumable commodities), while the commodity distribution shows an exponential decay. The wealth distribution shows interesting behavior: Gamma like distribution for uniform saving propensity and has the same power-law tail, as that of the money distribution, for a market with agents having random saving propensity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)