Summary

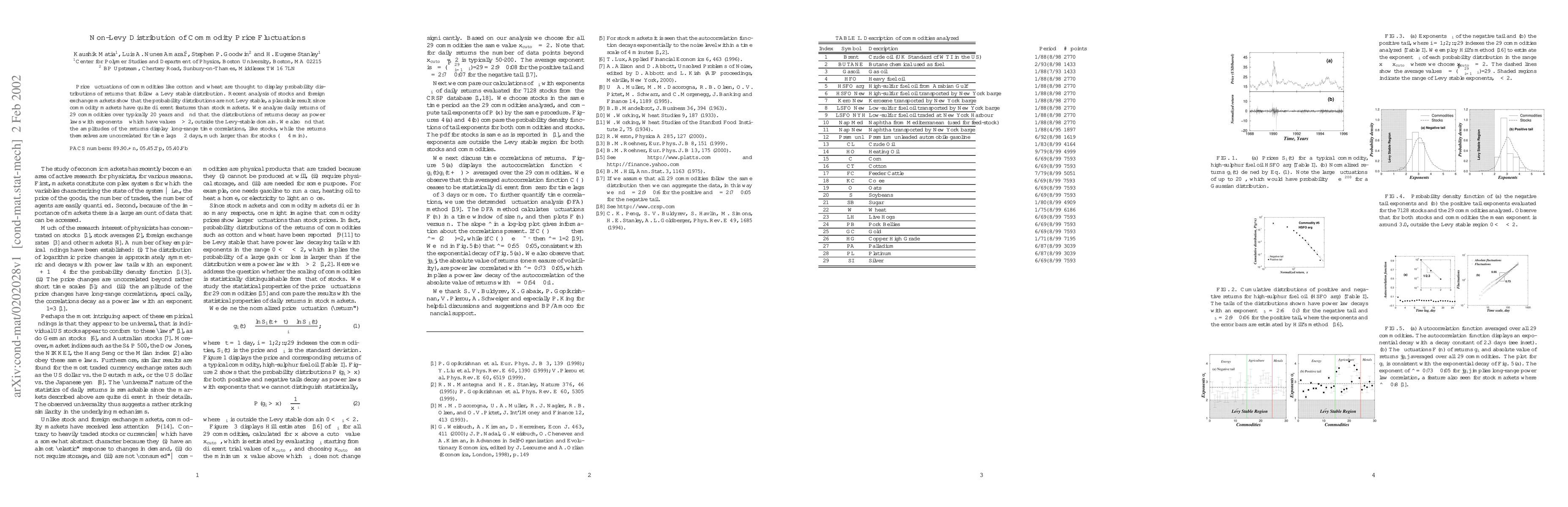

Price fluctuations of commodities like cotton and wheat are thought to display probability distributions of returns that follow a L\'evy stable distribution. Recent analysis of stocks and foreign exchange markets show that the probability distributions are not L\'evy stable, a plausible result since commodity markets have quite different features than stock markets. We analyze daily returns of 29 commodities over typically 20 years and find that the distributions of returns decay as power laws with exponents $\alpha$ which have values $\alpha > 2$, outside the L\'evy-stable domain. We also find that the amplitudes of the returns display long-range time correlations, like stocks, while the returns themselves are uncorrelated for time lags $\approx$ 2 days, much larger than for stocks ($\approx$ 4 min).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersKinetic market models with single commodity having price fluctuations

Arnab Chatterjee, Bikas K. Chakrabarti

Comments (0)