Summary

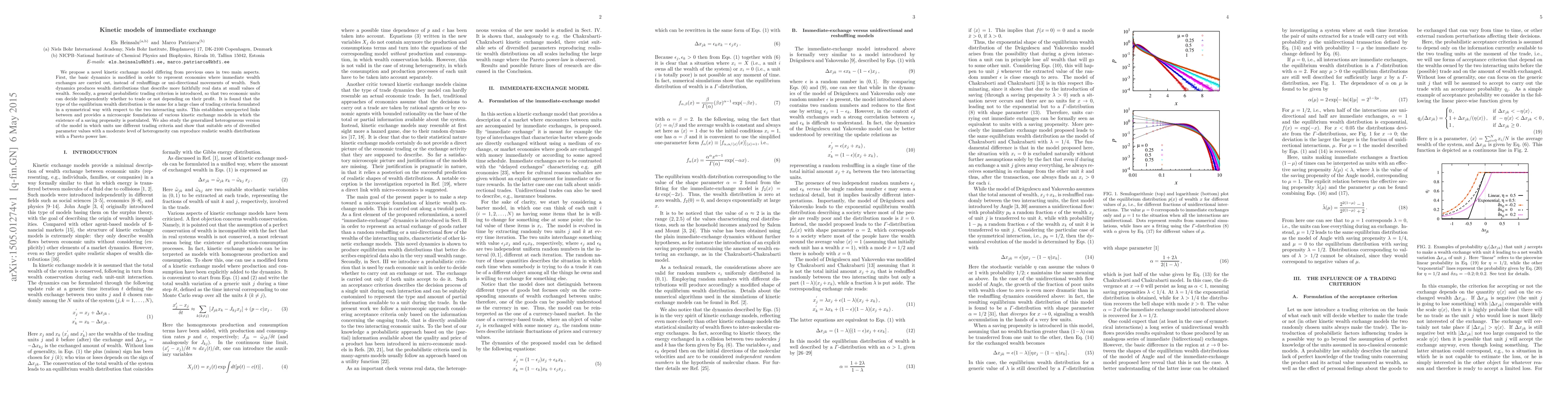

We propose a novel kinetic exchange model differing from previous ones in two main aspects. First, the basic dynamics is modified in order to represent economies where immediate wealth exchanges are carried out, instead of reshufflings or uni-directional movements of wealth. Such dynamics produces wealth distributions that describe more faithfully real data at small values of wealth. Secondly, a general probabilistic trading criterion is introduced, so that two economic units can decide independently whether to trade or not depending on their profit. It is found that the type of the equilibrium wealth distribution is the same for a large class of trading criteria formulated in a symmetrical way with respect to the two interacting units. This establishes unexpected links between and provides a microscopic foundations of various kinetic exchange models in which the existence of a saving propensity is postulated. We also study the generalized heterogeneous version of the model in which units use different trading criteria and show that suitable sets of diversified parameter values with a moderate level of heterogeneity can reproduce realistic wealth distributions with a Pareto power law.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper proposes a novel kinetic exchange model that represents economies with immediate wealth exchanges, differing from previous models that featured reshufflings or uni-directional wealth movements. The model introduces a general probabilistic trading criterion allowing units to independently decide on trades based on profit.

Key Results

- The model produces wealth distributions that more accurately describe real data at small values of wealth.

- A wide class of trading criteria, when formulated symmetrically, results in the same type of equilibrium wealth distribution.

- A heterogeneous version of the model, with units using diverse trading criteria, can reproduce realistic wealth distributions with a Pareto power law for moderate levels of heterogeneity.

Significance

This research provides a more realistic foundation for kinetic exchange models by incorporating immediate wealth exchanges and probabilistic trading criteria, linking various kinetic exchange models and offering microscopic justification.

Technical Contribution

The introduction of a general probabilistic trading criterion and the modification of basic dynamics to represent immediate wealth exchanges in economies.

Novelty

The paper distinguishes itself by proposing a kinetic exchange model that incorporates immediate wealth exchanges and a generalized probabilistic trading criterion, establishing unexpected links between various kinetic exchange models.

Limitations

- The study focuses on immediate exchange models and does not extensively explore other types of economic dynamics.

- The paper does not provide a comprehensive analysis of the impact of different trading criteria on large-scale economic systems.

Future Work

- Investigate the implications of this model on larger, more complex economic systems.

- Explore the effects of additional factors, such as external shocks or policy interventions, on the equilibrium wealth distributions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralized immediate exchange models and their symmetries

Federico Sau, Frank Redig

| Title | Authors | Year | Actions |

|---|

Comments (0)