Summary

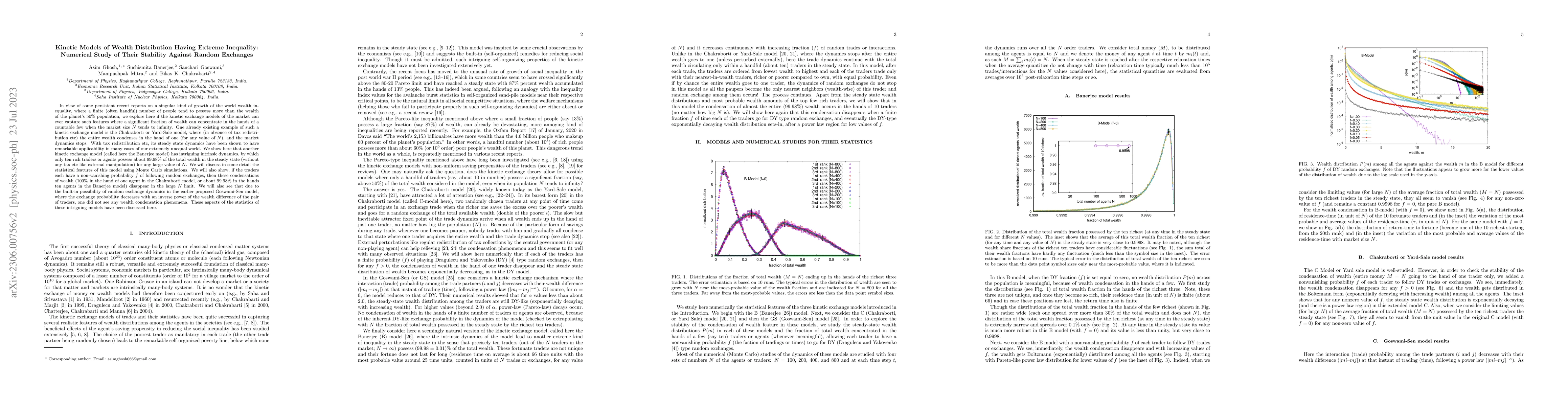

In view of some persistent recent reports on a singular kind of growth of the world wealth inequality, where a finite (often handful) number of people tend to possess more than the wealth of the planet's 50\% population, we explore here if the kinetic exchange models of the market can ever capture such features where a significant fraction of wealth can concentrate in the hands of a countable few when the market size $N$ tends to infinity. One already existing example of such a kinetic exchange model is the Chakraborti or Yard-Sale model, where (in absence of tax redistribution etc) the entire wealth condenses in the hand of one (for any value of $N$), and the market dynamics stops. With tax redistribution etc, its steady state dynamics have been shown to have remarkable applicability in many cases of our extremely unequal world. We show here that another kinetic exchange model (called here the Banerjee model) has intriguing intrinsic dynamics, by which only ten rich traders or agents possess about 99.98\% of the total wealth in the steady state (without any tax etc like external manipulation) for any large value of $N$. We will discuss in some detail the statistical features of this model using Monte Carlo simulations. We will also show, if the traders each have a non-vanishing probability $f$ of following random exchanges, then these condensations of wealth (100\% in the hand of one agent in the Chakraborti model, or about 99.98\% in the hands ten agents in the Banerjee model) disappear in the large $N$ limit. We will also see that due to the built-in possibility of random exchange dynamics in the earlier proposed Goswami-Sen model, where the exchange probability decreases with an inverse power of the wealth difference of the pair of traders, one did not see any wealth condensation phenomena.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEffects of vaccination efficacy on wealth distribution in kinetic epidemic models

Mattia Zanella, Giuseppe Toscani, Lorenzo Pareschi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)