Summary

Event extraction is a classic task in natural language processing with wide use in handling large amount of yet rapidly growing financial, legal, medical, and government documents which often contain multiple events with their elements scattered and mixed across the documents, making the problem much more difficult. Though the underlying relations between event elements to be extracted provide helpful contextual information, they are somehow overlooked in prior studies. We showcase the enhancement to this task brought by utilizing the knowledge graph that captures entity relations and their attributes. We propose a first event extraction framework that embeds a knowledge graph through a Graph Neural Network and integrates the embedding with regular features, all at document-level. Specifically, for extracting events from Chinese financial announcements, our method outperforms the state-of-the-art method by 5.3% in F1-score.

AI Key Findings

Generated Sep 07, 2025

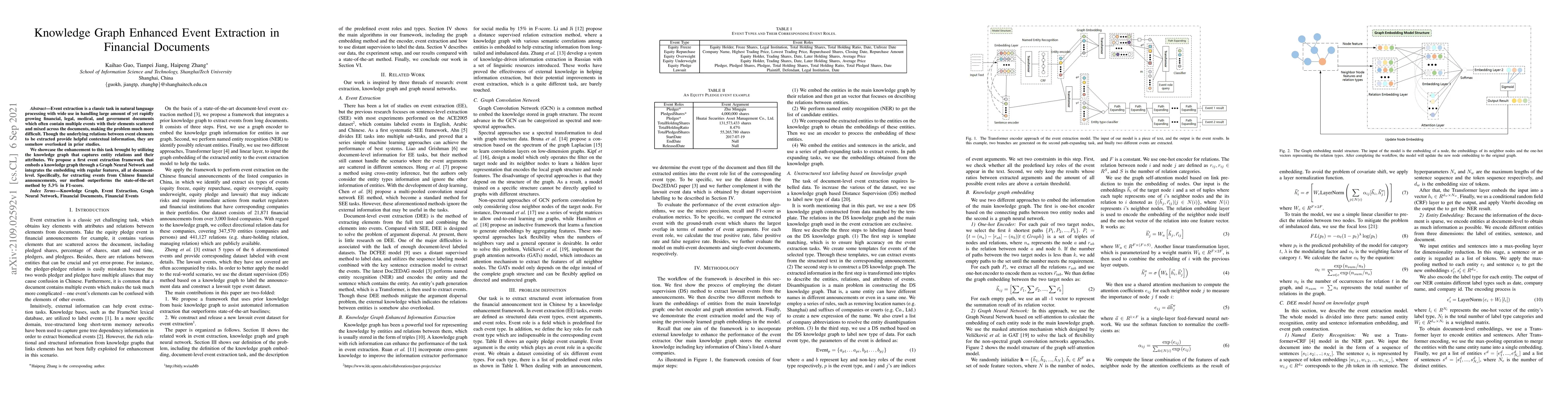

Methodology

The paper proposes a knowledge graph enhanced event extraction framework for financial documents, integrating a Graph Neural Network to embed the knowledge graph and combine it with regular features at the document level. This method significantly outperforms the state-of-the-art method by 5.3% in F1-score for extracting events from Chinese financial announcements.

Key Results

- The proposed framework outperforms the existing state-of-the-art method by 5.3% in F1-score for event extraction from Chinese financial announcements.

- Two embedding methods are compared: one-hot encoder and Graph Neural Network (GNN), with GNN showing superior performance.

- The GNN+Transformer model achieves the best overall F1-score of 81.7%, surpassing the Doc2EDAG model by 5.4% in precision, 5.2% in recall, and 5.3% in F1-score.

- The model demonstrates significant improvements for EF (10.0%), ER (6.1%), EU (10.0%), and EP (5.6%) event categories.

Significance

This research is significant as it enhances event extraction in financial documents by leveraging knowledge graphs, which helps in capturing contextual information from relations between event elements, often overlooked in previous studies.

Technical Contribution

The main technical contribution is a novel event extraction framework that embeds a knowledge graph using a Graph Neural Network and integrates it with regular features at the document level, enhancing event extraction performance in financial documents.

Novelty

The novelty of this work lies in the explicit incorporation of entity relations and attributes from a knowledge graph to improve event extraction, which is underexplored in prior studies.

Limitations

- The study is limited to Chinese financial announcements and may not generalize directly to other languages or document types without adaptation.

- The performance evaluation is based on specific financial event types, so its applicability to broader domains remains to be explored.

Future Work

- Apply the framework to other domains such as legal, medical, and government documents.

- Investigate the integration of the proposed method with other NLP tasks like relation extraction and sentence-level event extraction.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHarnessing Generative LLMs for Enhanced Financial Event Entity Extraction Performance

Ji-jun Park, Soo-joon Choi

| Title | Authors | Year | Actions |

|---|

Comments (0)