Summary

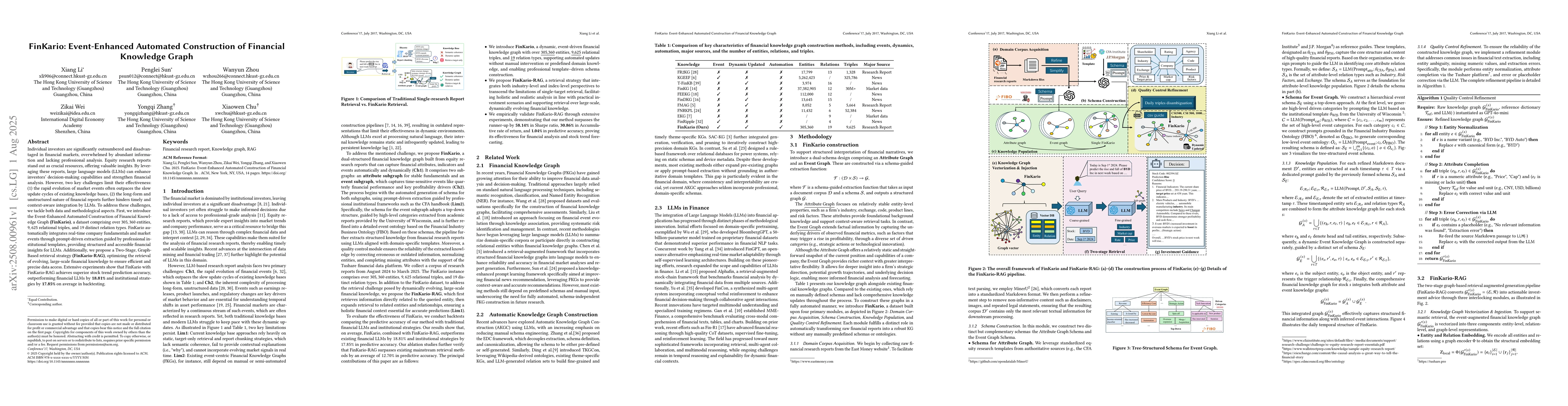

Individual investors are significantly outnumbered and disadvantaged in financial markets, overwhelmed by abundant information and lacking professional analysis. Equity research reports stand out as crucial resources, offering valuable insights. By leveraging these reports, large language models (LLMs) can enhance investors' decision-making capabilities and strengthen financial analysis. However, two key challenges limit their effectiveness: (1) the rapid evolution of market events often outpaces the slow update cycles of existing knowledge bases, (2) the long-form and unstructured nature of financial reports further hinders timely and context-aware integration by LLMs. To address these challenges, we tackle both data and methodological aspects. First, we introduce the Event-Enhanced Automated Construction of Financial Knowledge Graph (FinKario), a dataset comprising over 305,360 entities, 9,625 relational triples, and 19 distinct relation types. FinKario automatically integrates real-time company fundamentals and market events through prompt-driven extraction guided by professional institutional templates, providing structured and accessible financial insights for LLMs. Additionally, we propose a Two-Stage, Graph-Based retrieval strategy (FinKario-RAG), optimizing the retrieval of evolving, large-scale financial knowledge to ensure efficient and precise data access. Extensive experiments show that FinKario with FinKario-RAG achieves superior stock trend prediction accuracy, outperforming financial LLMs by 18.81% and institutional strategies by 17.85% on average in backtesting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersUnsupervised Knowledge Graph Construction and Event-centric Knowledge Infusion for Scientific NLI

Xiaodong Wang, Xiaowei Xu, Guodong Long et al.

Comments (0)