Summary

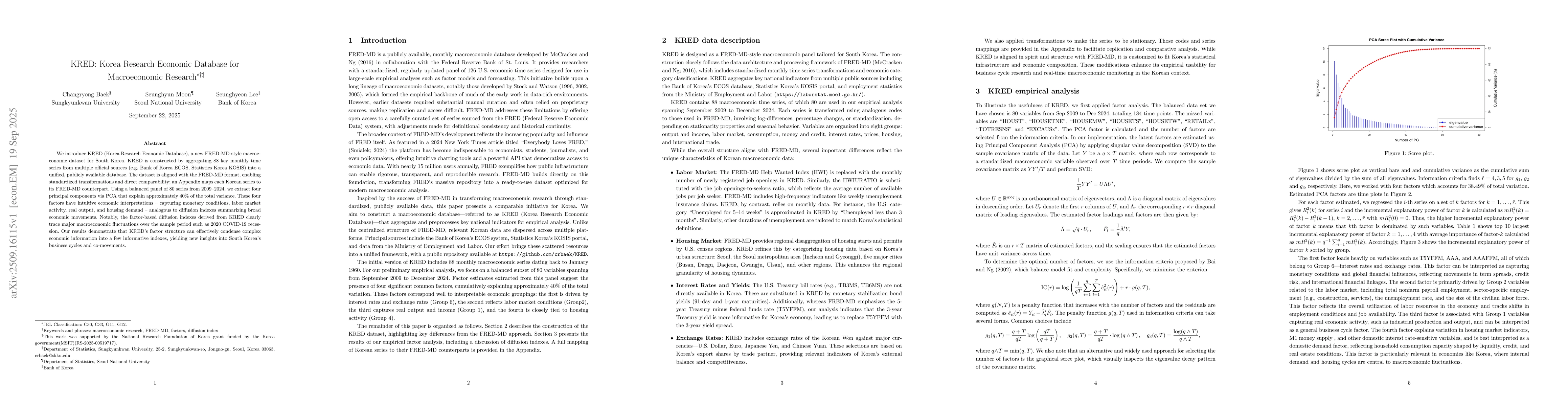

We introduce KRED (Korea Research Economic Database), a new FRED MD style macroeconomic dataset for South Korea. KRED is constructed by aggregating 88 key monthly time series from multiple official sources (e.g., Bank of Korea ECOS, Statistics Korea KOSIS) into a unified, publicly available database. The dataset is aligned with the FRED MD format, enabling standardized transformations and direct comparability; an Appendix maps each Korean series to its FRED MD counterpart. Using a balanced panel of 80 series from 2009 to 2024, we extract four principal components via PCA that explain approximately 40% of the total variance. These four factors have intuitive economic interpretations, capturing monetary conditions, labor market activity, real output, and housing demand, analogous to diffusion indexes summarizing broad economic movements. Notably, the factor based diffusion indexes derived from KRED clearly trace major macroeconomic fluctuations over the sample period such as the 2020 COVID 19 recession. Our results demonstrate that KRED's factor structure can effectively condense complex economic information into a few informative indexes, yielding new insights into South Korea's business cycles and co movements.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study constructs KRED by aggregating 88 monthly time series from official sources into a FRED MD-style database. Principal Component Analysis (PCA) is applied to extract four factors representing macroeconomic dimensions.

Key Results

- Four factors explain ~40% of total variance, capturing monetary conditions, labor market, real output, and housing demand.

- Factor-based diffusion indexes effectively track major macroeconomic fluctuations like the 2020 COVID-19 recession.

- The factors provide nuanced insights into South Korea's business cycles and sectoral responses to shocks.

Significance

KRED offers a standardized, publicly available database for macroeconomic research in South Korea, enabling comparable analysis with international datasets and improving forecasting and policy monitoring.

Technical Contribution

Development of a FRED MD-style database for South Korea with standardized transformations and PCA-based factor extraction for macroeconomic analysis.

Novelty

First comprehensive macroeconomic database for South Korea aligned with FRED MD format, enabling direct comparability and factor-based diffusion index construction for business cycle analysis.

Limitations

- The analysis focuses on a specific time period (2009-2024) which may limit generalizability.

- The factor interpretation relies on mapping to FRED MD series which may introduce potential misalignment.

Future Work

- Expanding the database to include more granular regional or industry-specific data.

- Integrating real-time data streams for improved monitoring capabilities.

- Comparative studies with other countries' databases to identify common patterns.

Paper Details

PDF Preview

Similar Papers

Found 5 papersAgentic Workflows for Economic Research: Design and Implementation

Zhongli Wang, Herbert Dawid, Philipp Harting et al.

Comments (0)