Authors

Summary

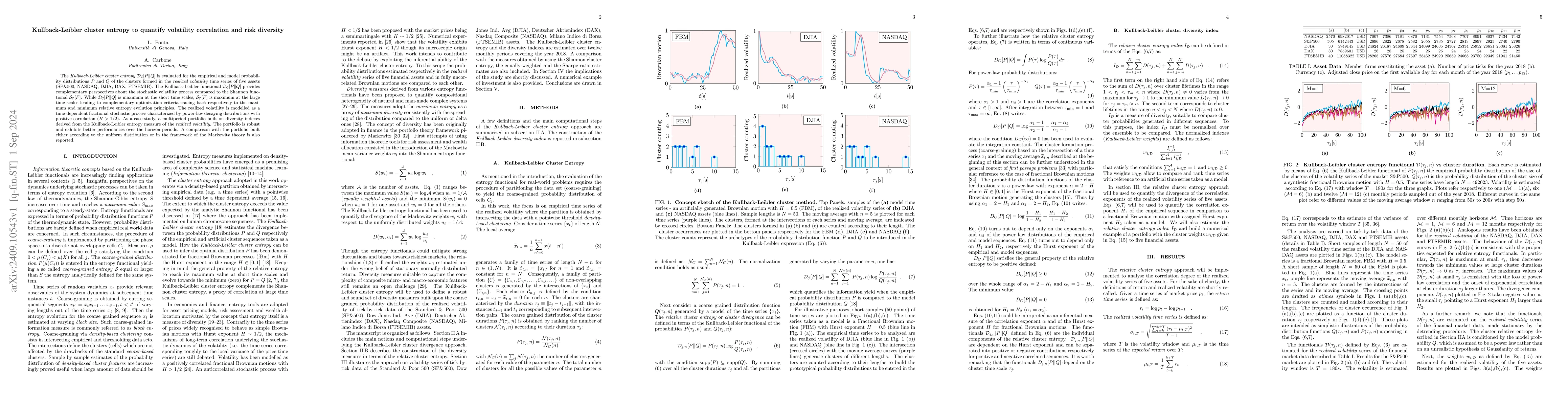

The Kullback-Leibler cluster entropy $\mathcal{D_{C}}[P \| Q] $ is evaluated for the empirical and model probability distributions $P$ and $Q$ of the clusters formed in the realized volatility time series of five assets (SP\&500, NASDAQ, DJIA, DAX, FTSEMIB). The Kullback-Leibler functional $\mathcal{D_{C}}[P \| Q] $ provides complementary perspectives about the stochastic volatility process compared to the Shannon functional $\mathcal{S_{C}}[P]$. While $\mathcal{D_{C}}[P \| Q] $ is maximum at the short time scales, $\mathcal{S_{C}}[P]$ is maximum at the large time scales leading to complementary optimization criteria tracing back respectively to the maximum and minimum relative entropy evolution principles. The realized volatility is modelled as a time-dependent fractional stochastic process characterized by power-law decaying distributions with positive correlation ($H>1/2$). As a case study, a multiperiod portfolio built on diversity indexes derived from the Kullback-Leibler entropy measure of the realized volatility. The portfolio is robust and exhibits better performances over the horizon periods. A comparison with the portfolio built either according to the uniform distribution or in the framework of the Markowitz theory is also reported.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)