Summary

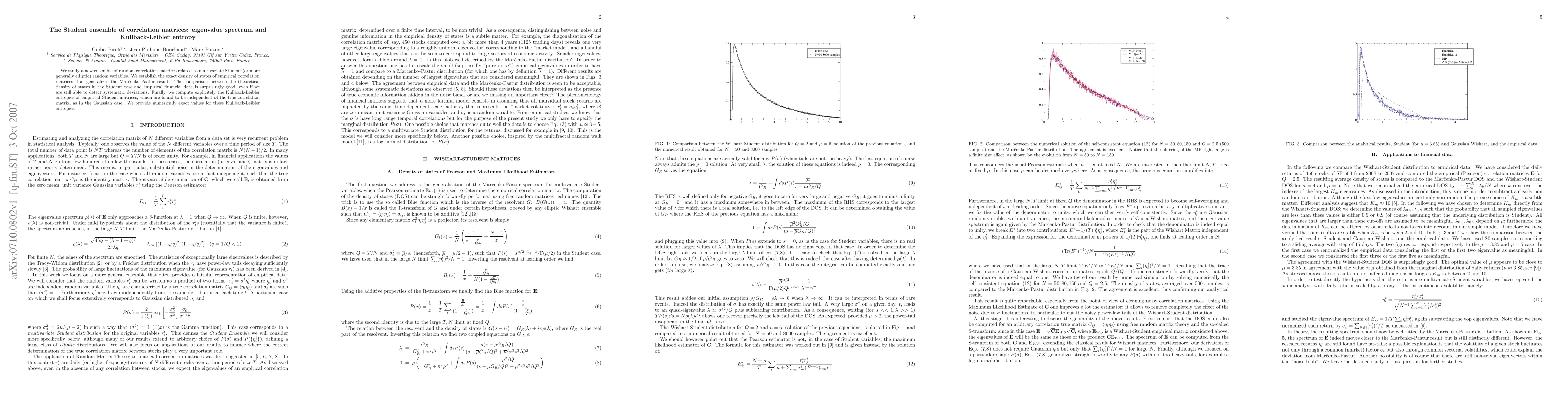

We study a new ensemble of random correlation matrices related to multivariate Student (or more generally elliptic) random variables. We establish the exact density of states of empirical correlation matrices that generalizes the Marcenko-Pastur result. The comparison between the theoretical density of states in the Student case and empirical financial data is surprisingly good, even if we are still able to detect systematic deviations. Finally, we compute explicitely the Kullback-Leibler entropies of empirical Student matrices, which are found to be independent of the true correlation matrix, as in the Gaussian case. We provide numerically exact values for these Kullback-Leibler entropies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)