Summary

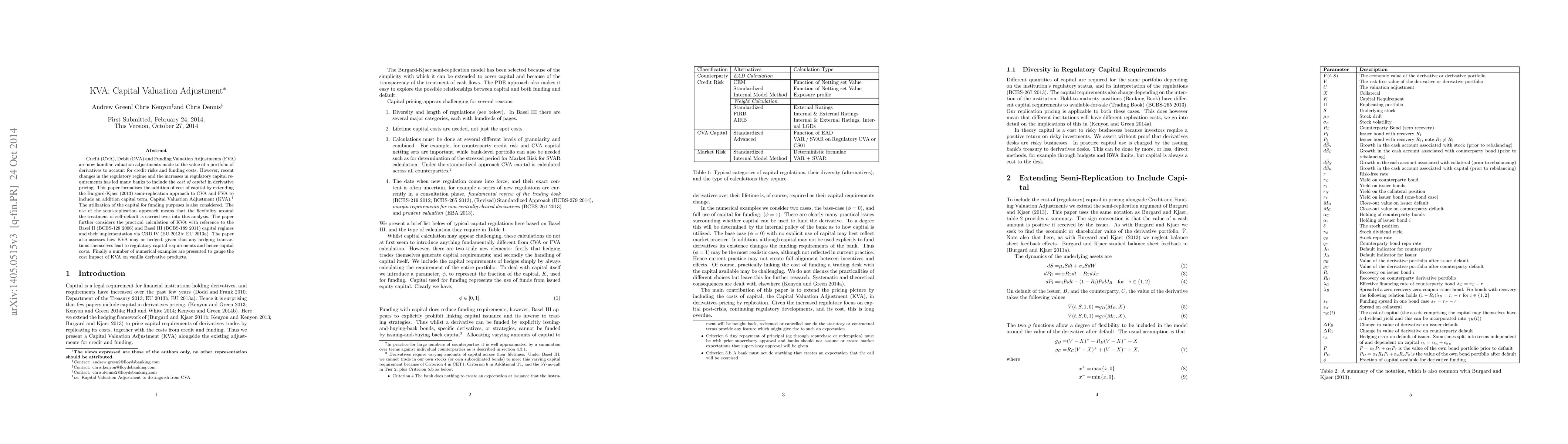

Credit (CVA), Debit (DVA) and Funding Valuation Adjustments (FVA) are now familiar valuation adjustments made to the value of a portfolio of derivatives to account for credit risks and funding costs. However, recent changes in the regulatory regime and the increases in regulatory capital requirements has led many banks to include the cost of capital in derivative pricing. This paper formalises the addition of cost of capital by extending the Burgard-Kjaer (2013) semi-replication approach to CVA and FVA to include an addition capital term, Capital Valuation Adjustment (KVA, i.e. Kapital Valuation Adjustment to distinguish from CVA.) The utilization of the capital for funding purposes is also considered. The use of the semi-replication approach means that the flexibility around the treatment of self-default is carried over into this analysis. The paper further considers the practical calculation of KVA with reference to the Basel II (BCBS-128) and Basel III (BCBS-189) capital regimes and their implementation via CRD IV. The paper also assesses how KVA may be hedged, given that any hedging transactions themselves lead to regulatory capital requirements and hence capital costs. Finally a number of numerical examples are presented to gauge the cost impact of KVA on vanilla derivative products.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMathematical models and numerical methods for a capital valuation adjustment (KVA) problem

C. Vázquez, D. Trevisani, J. G. López-Salas et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)