Summary

In this work we rigorously establish mathematical models to obtain the capital valuation adjustment (KVA) as part of the total valuation adjustments (XVAs). For this purpose, we use a semi-replication strategy based on market theory. We formulate single-factor models in terms of expectations and PDEs. For PDEs formulation, we rigorously obtain the existence and uniqueness of the solution, as well as some regularity and qualitative properties of the solution. Moreover, appropriate numerical methods are proposed for solving the corresponding PDEs. Finally, some examples show the numerical results for call and put European options and the corresponding XVA that includes the KVA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

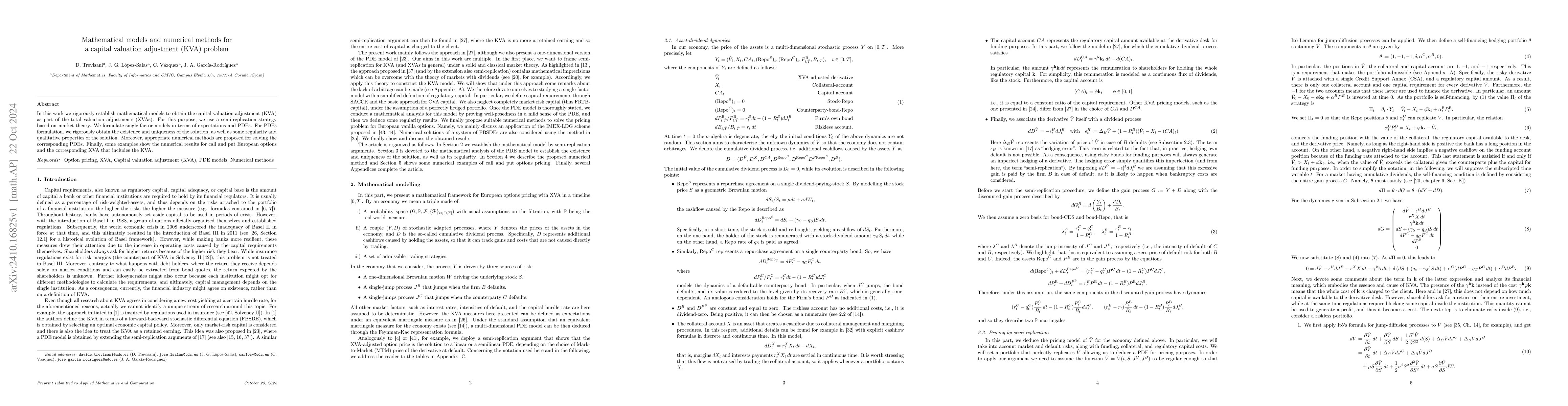

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)