Summary

In financial trading, return prediction is one of the foundation for a successful trading system. By the fast development of the deep learning in various areas such as graphical processing, natural language, it has also demonstrate significant edge in handling with financial data. While the success of the deep learning relies on huge amount of labeled sample, labeling each time/event as profitable or unprofitable, under the transaction cost, especially in the high-frequency trading world, suffers from serious label imbalance issue.In this paper, we adopts rigurious end-to-end deep learning framework with comprehensive label imbalance adjustment methods and succeed in predicting in high-frequency return in the Chinese future market. The code for our method is publicly available at https://github.com/RS2002/Label-Unbalance-in-High-Frequency-Trading .

AI Key Findings

Generated Jun 10, 2025

Methodology

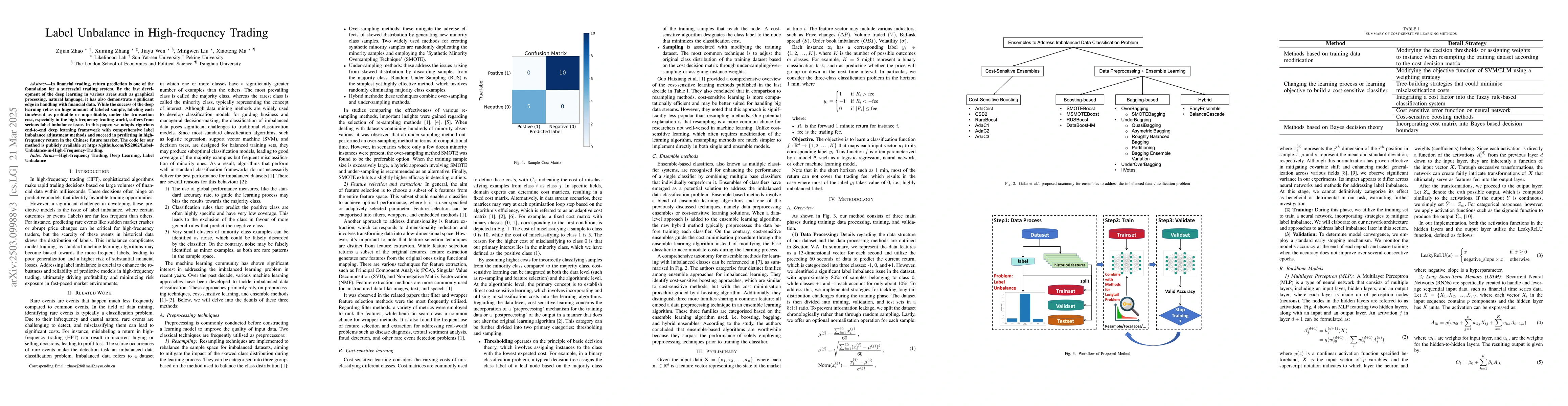

The paper adopts a rigorous end-to-end deep learning framework, incorporating comprehensive label imbalance adjustment methods to predict high-frequency returns in the Chinese futures market. Methods include under-sampling, fixed and adaptive cost matrix approaches, and various backbone models such as MLP, LSTM, and Mamba.

Key Results

- Successful prediction of high-frequency returns in the Chinese futures market using deep learning with label imbalance adjustments.

- LSTM and Mamba models generally outperform MLP in most scenarios, likely due to their suitability for capturing temporal relationships.

- Sensitive loss and loss weighting methods show better performance than resampling and focal loss for addressing label imbalance in this task.

Significance

This research demonstrates the efficiency of machine learning methods in high-frequency trading with label imbalance, providing insights and experiences for future research in this domain.

Technical Contribution

The paper presents a robust deep learning framework with comprehensive label imbalance adjustment methods for high-frequency return prediction in financial markets.

Novelty

The work combines various deep learning models and cost-sensitive learning techniques to tackle label imbalance in high-frequency trading, offering a practical solution for this challenge.

Limitations

- Financial data contains significant noise, complicating the training process and only minimally improved with normalization.

- A domain shift was observed, suggesting that testing data may have a noticeable domain gap from the training data, indicating a gradual change in data distribution over time.

Future Work

- Explore improved model structures, such as using a Gaussian distribution for regression tasks instead of predicting a single value.

- Investigate cross-domain methods to address the domain shift problem.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExploring the Advantages of Transformers for High-Frequency Trading

Paul Bilokon, Fazl Barez, Arthur Gervais et al.

Quantum Quantitative Trading: High-Frequency Statistical Arbitrage Algorithm

Yu-Chun Wu, Guo-Ping Guo, Zhao-Yun Chen et al.

No citations found for this paper.

Comments (0)