Summary

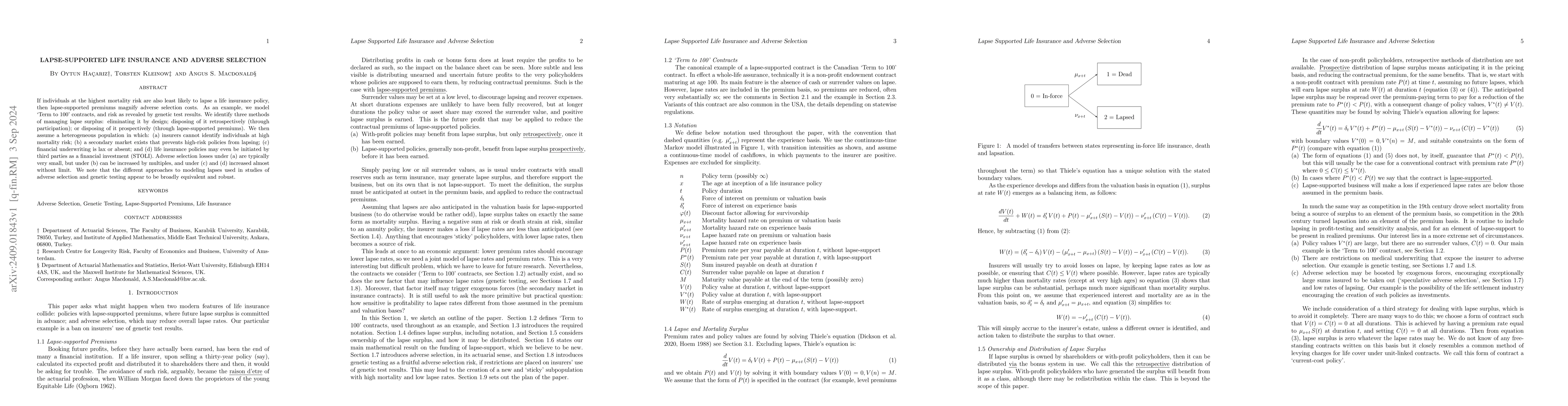

If individuals at the highest mortality risk are also least likely to lapse a life insurance policy, then lapse-supported premiums magnify adverse selection costs. As an example, we model 'Term to 100' contracts, and risk as revealed by genetic test results. We identify three methods of managing lapse surplus: eliminating it by design; disposing of it retrospectively (through participation); or disposing of it prospectively (through lapse-supported premiums). We then assume a heterogeneous population in which: (a) insurers cannot identify individuals at high mortality risk; (b) a secondary market exists that prevents high-risk policies from lapsing; (c) financial underwriting is lax or absent; and (d) life insurance policies may even be initiated by third parties as a financial investment (STOLI). Adverse selection losses under (a) are typically very small, but under (b) can be increased by multiples, and under (c) and (d) increased almost without limit. We note that the different approaches to modeling lapses used in studies of adverse selection and genetic testing appear to be broadly equivalent and robust.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLapse risk modelling in insurance: a Bayesian mixture approach

Viviana G. R. Lobo, Mariane B. Alves, Thais C. O. Fonseca

On Technical Bases and Surplus in Life Insurance

Torsten Kleinow, Angus S. Macdonald, Oytun Haçarız

| Title | Authors | Year | Actions |

|---|

Comments (0)