Authors

Summary

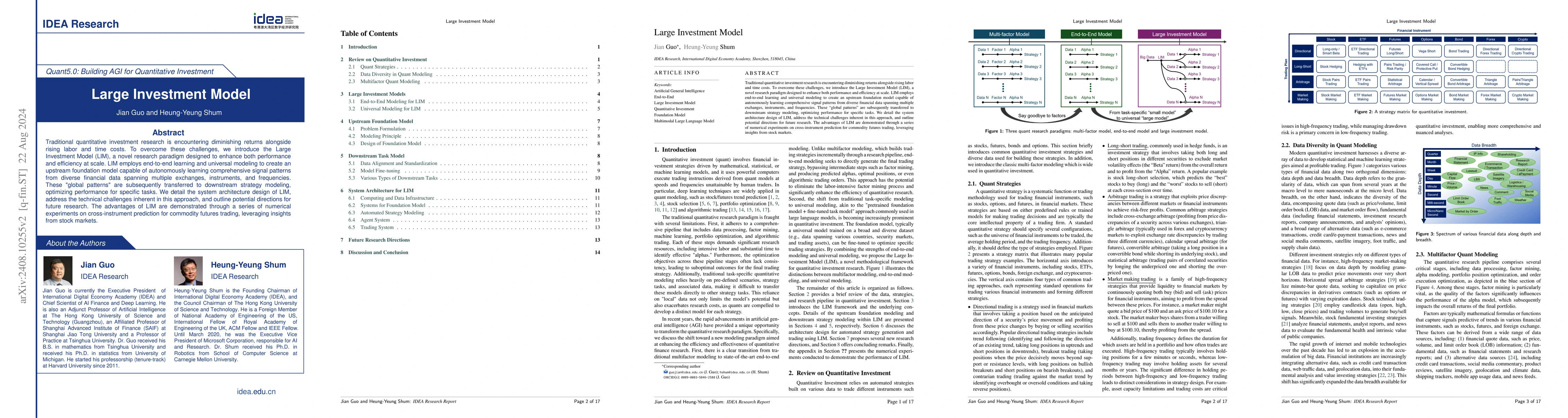

Traditional quantitative investment research is encountering diminishing returns alongside rising labor and time costs. To overcome these challenges, we introduce the Large Investment Model (LIM), a novel research paradigm designed to enhance both performance and efficiency at scale. LIM employs end-to-end learning and universal modeling to create an upstream foundation model capable of autonomously learning comprehensive signal patterns from diverse financial data spanning multiple exchanges, instruments, and frequencies. These "global patterns" are subsequently transferred to downstream strategy modeling, optimizing performance for specific tasks. We detail the system architecture design of LIM, address the technical challenges inherent in this approach, and outline potential directions for future research. The advantages of LIM are demonstrated through a series of numerical experiments on cross-instrument prediction for commodity futures trading, leveraging insights from stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInvestLM: A Large Language Model for Investment using Financial Domain Instruction Tuning

Yi Yang, Kar Yan Tam, Yixuan Tang

No citations found for this paper.

Comments (0)