Authors

Summary

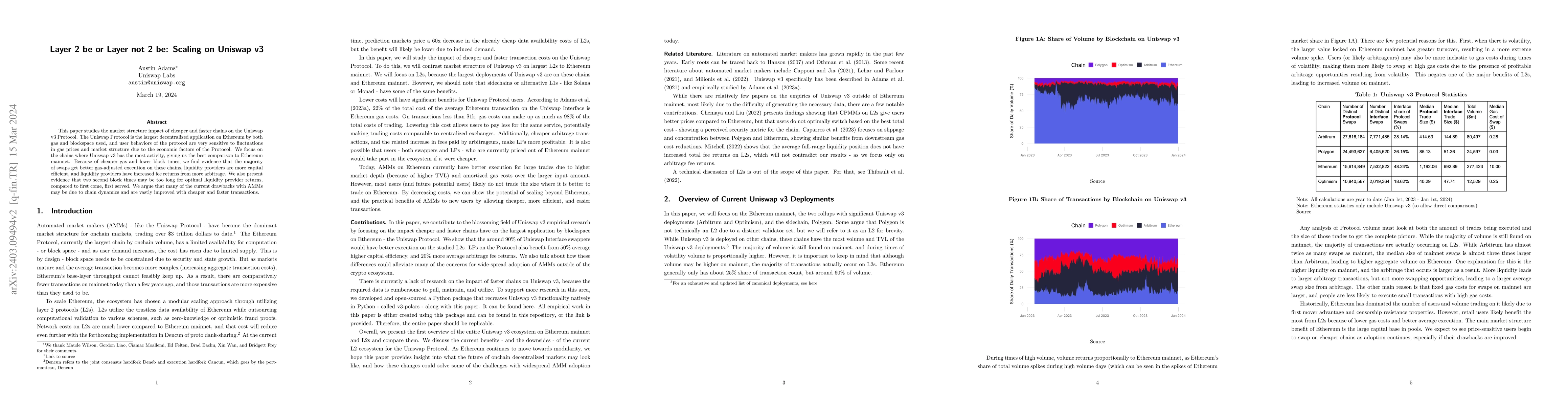

This paper studies the market structure impact of cheaper and faster chains on the Uniswap v3 Protocol. The Uniswap Protocol is the largest decentralized application on Ethereum by both gas and blockspace used, and user behaviors of the protocol are very sensitive to fluctuations in gas prices and market structure due to the economic factors of the Protocol. We focus on the chains where Uniswap v3 has the most activity, giving us the best comparison to Ethereum mainnet. Because of cheaper gas and lower block times, we find evidence that the majority of swaps get better gas-adjusted execution on these chains, liquidity providers are more capital efficient, and liquidity providers have increased fee returns from more arbitrage. We also present evidence that two second block times may be too long for optimal liquidity provider returns, compared to first come, first served. We argue that many of the current drawbacks with AMMs may be due to chain dynamics and are vastly improved with cheaper and faster transactions

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisks and Returns of Uniswap V3 Liquidity Providers

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

Exploring Price Accuracy on Uniswap V3 in Times of Distress

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

| Title | Authors | Year | Actions |

|---|

Comments (0)