Authors

Summary

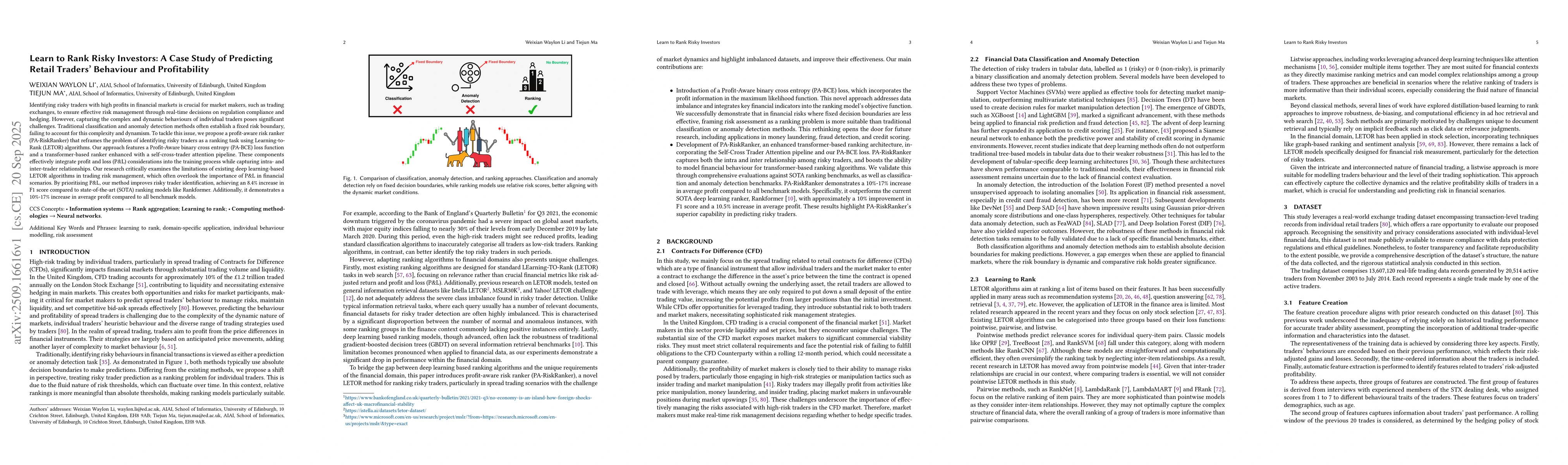

Identifying risky traders with high profits in financial markets is crucial for market makers, such as trading exchanges, to ensure effective risk management through real-time decisions on regulation compliance and hedging. However, capturing the complex and dynamic behaviours of individual traders poses significant challenges. Traditional classification and anomaly detection methods often establish a fixed risk boundary, failing to account for this complexity and dynamism. To tackle this issue, we propose a profit-aware risk ranker (PA-RiskRanker) that reframes the problem of identifying risky traders as a ranking task using Learning-to-Rank (LETOR) algorithms. Our approach features a Profit-Aware binary cross entropy (PA-BCE) loss function and a transformer-based ranker enhanced with a self-cross-trader attention pipeline. These components effectively integrate profit and loss (P&L) considerations into the training process while capturing intra- and inter-trader relationships. Our research critically examines the limitations of existing deep learning-based LETOR algorithms in trading risk management, which often overlook the importance of P&L in financial scenarios. By prioritising P&L, our method improves risky trader identification, achieving an 8.4% increase in F1 score compared to state-of-the-art (SOTA) ranking models like Rankformer. Additionally, it demonstrates a 10%-17% increase in average profit compared to all benchmark models.

AI Key Findings

Generated Sep 30, 2025

Methodology

The research introduces a ranking-based methodology for detecting risky traders, integrating a Profit-Aware Binary CrossEntropy (PA-BCE) loss function with a Self-Cross Trader Attention pipeline in the PA-RiskRanker model. It combines deep learning techniques with financial domain knowledge to optimize Profit and Loss (P&L) metrics.

Key Results

- PA-RiskRanker outperforms existing models in traditional ranking metrics and surpasses recent models in classification and anomaly detection tasks.

- The two-step evaluation process demonstrates the model's ability to enhance the performance of interpretable classifiers, particularly in financial decision-making contexts.

- The integration of PA-BCE loss and Self-Cross Trader Attention significantly improves the detection of high-risk traders, especially in extreme-risk cases.

Significance

This research provides a novel approach for financial risk management by leveraging ranking-based methods and profit-aware metrics, offering practical applications in credit scoring, anti-money laundering, and fraud detection. It addresses the complexities of financial data while maintaining interpretability for critical decision-making.

Technical Contribution

The technical contribution lies in the development of the PA-BCE loss function combined with the Self-Cross Trader Attention mechanism, which enables the model to effectively capture nuanced financial patterns and optimize P&L metrics.

Novelty

This work is novel due to its focus on profit-aware ranking for financial risk detection, integrating both structured and unstructured data, and emphasizing interpretability alongside predictive accuracy in financial applications.

Limitations

- The model's effectiveness may depend on the quality and representativeness of the financial data used for training.

- The integration of textual information from financial domains requires further refinement to fully leverage unstructured data.

Future Work

- Extending the framework to incorporate advanced natural language processing techniques for better utilization of textual financial data.

- Adapting the methodology to handle domain-specific regulatory requirements in credit scoring and anti-money laundering contexts.

- Exploring ensemble learning frameworks to combine the PA-RiskRanker model with other interpretable models for enhanced performance.

Paper Details

PDF Preview

Similar Papers

Found 5 papersThe Impact of Retail Investors Sentiment on Conditional Volatility of Stocks and Bonds

Elroi Hadad, Haim Kedar-Levy

The mean-variance portfolio selection based on the average and current profitability of the risky asset

Yu Li, Yuhan Wu, Shuhua Zhang

Comments (0)