Tiejun Ma

9 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

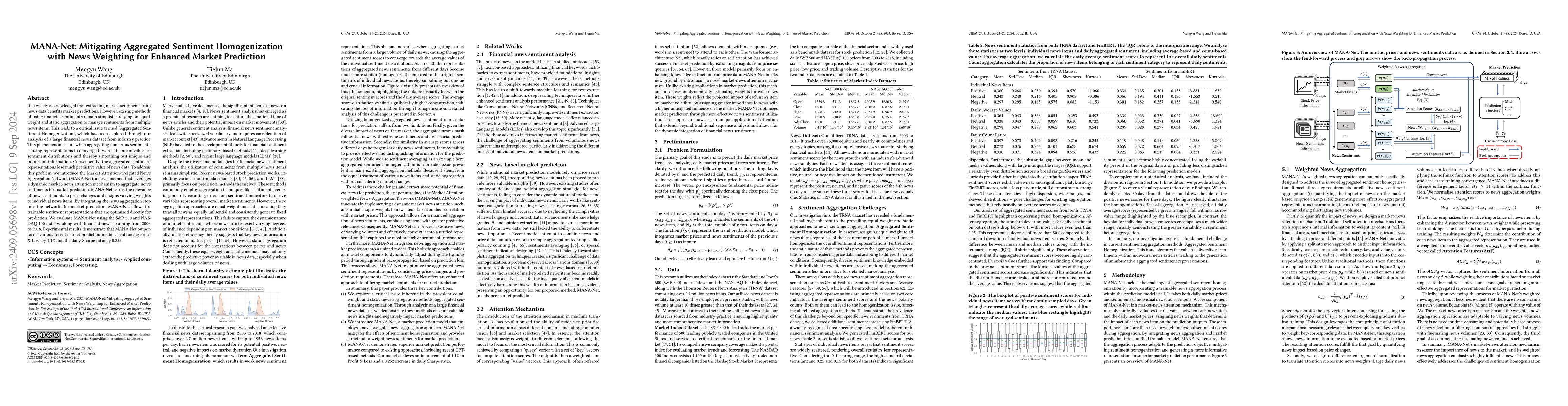

MANA-Net: Mitigating Aggregated Sentiment Homogenization with News Weighting for Enhanced Market Prediction

It is widely acknowledged that extracting market sentiments from news data benefits market predictions. However, existing methods of using financial sentiments remain simplistic, relying on equal-weig...

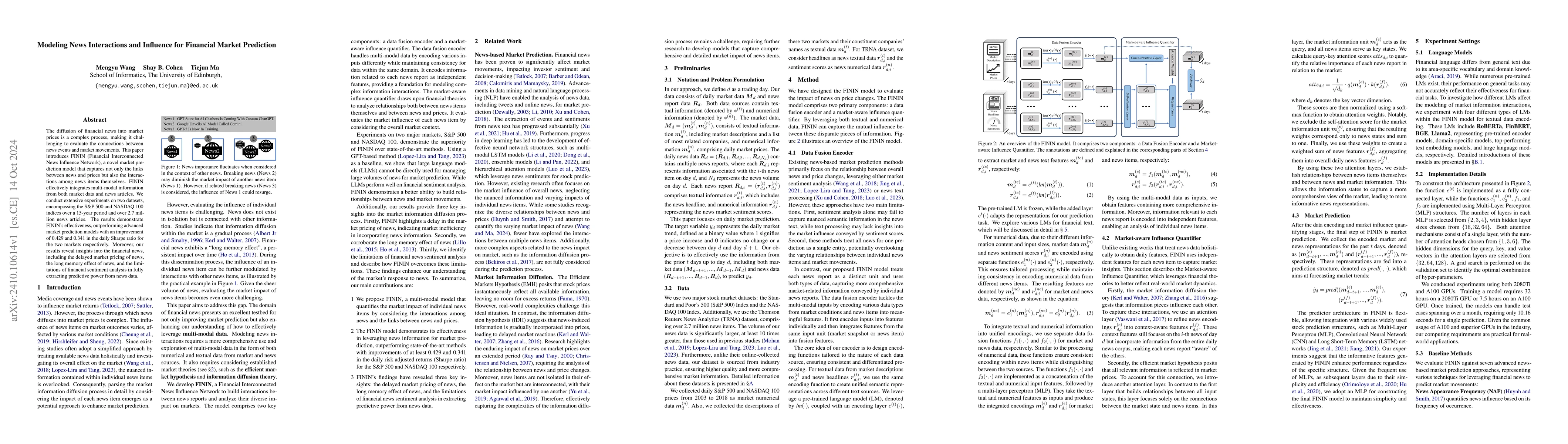

Modeling News Interactions and Influence for Financial Market Prediction

The diffusion of financial news into market prices is a complex process, making it challenging to evaluate the connections between news events and market movements. This paper introduces FININ (Financ...

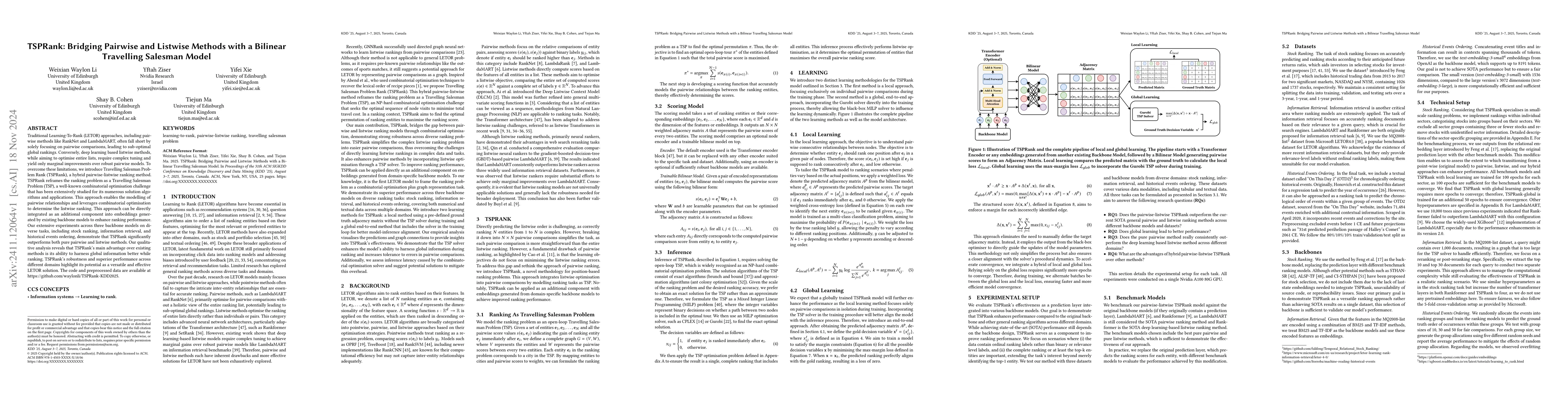

TSPRank: Bridging Pairwise and Listwise Methods with a Bilinear Travelling Salesman Model

Traditional Learning-To-Rank (LETOR) approaches, including pairwise methods like RankNet and LambdaMART, often fall short by solely focusing on pairwise comparisons, leading to sub-optimal global rank...

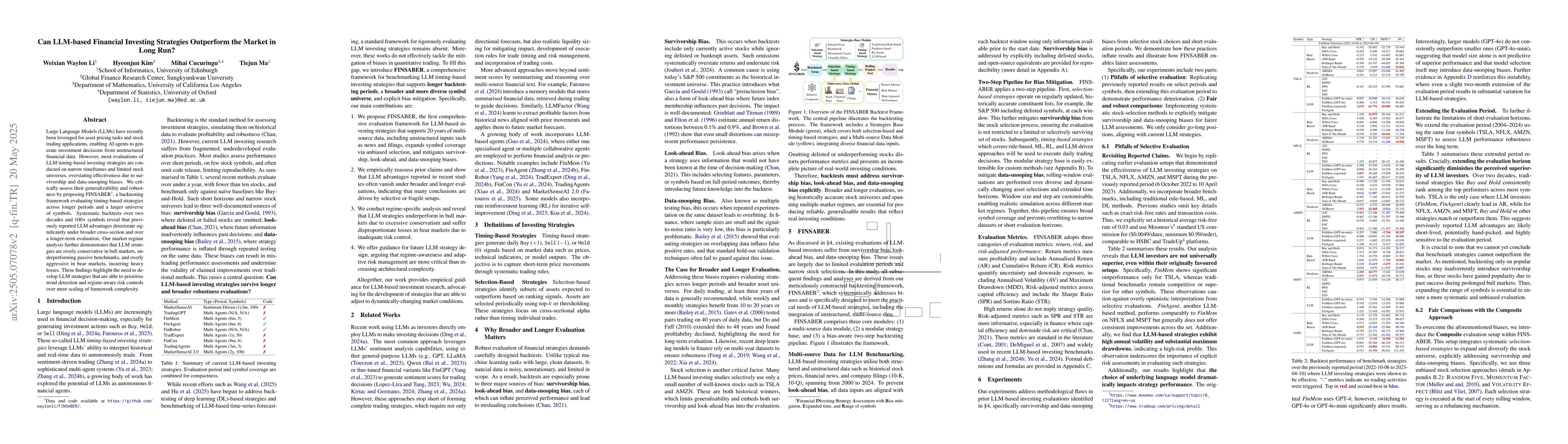

Can LLM-based Financial Investing Strategies Outperform the Market in Long Run?

Large Language Models (LLMs) have recently been leveraged for asset pricing tasks and stock trading applications, enabling AI agents to generate investment decisions from unstructured financial data. ...

Pre-training Time Series Models with Stock Data Customization

Stock selection, which aims to predict stock prices and identify the most profitable ones, is a crucial task in finance. While existing methods primarily focus on developing model structures and build...

FinGEAR: Financial Mapping-Guided Enhanced Answer Retrieval

Financial disclosures such as 10-K filings present challenging retrieval problems due to their length, regulatory section hierarchy, and domain-specific language, which standard retrieval-augmented ge...

Learn to Rank Risky Investors: A Case Study of Predicting Retail Traders' Behaviour and Profitability

Identifying risky traders with high profits in financial markets is crucial for market makers, such as trading exchanges, to ensure effective risk management through real-time decisions on regulation ...

GRAB: A Risk Taxonomy--Grounded Benchmark for Unsupervised Topic Discovery in Financial Disclosures

Risk categorization in 10-K risk disclosures matters for oversight and investment, yet no public benchmark evaluates unsupervised topic models for this task. We present GRAB, a finance-specific benchm...

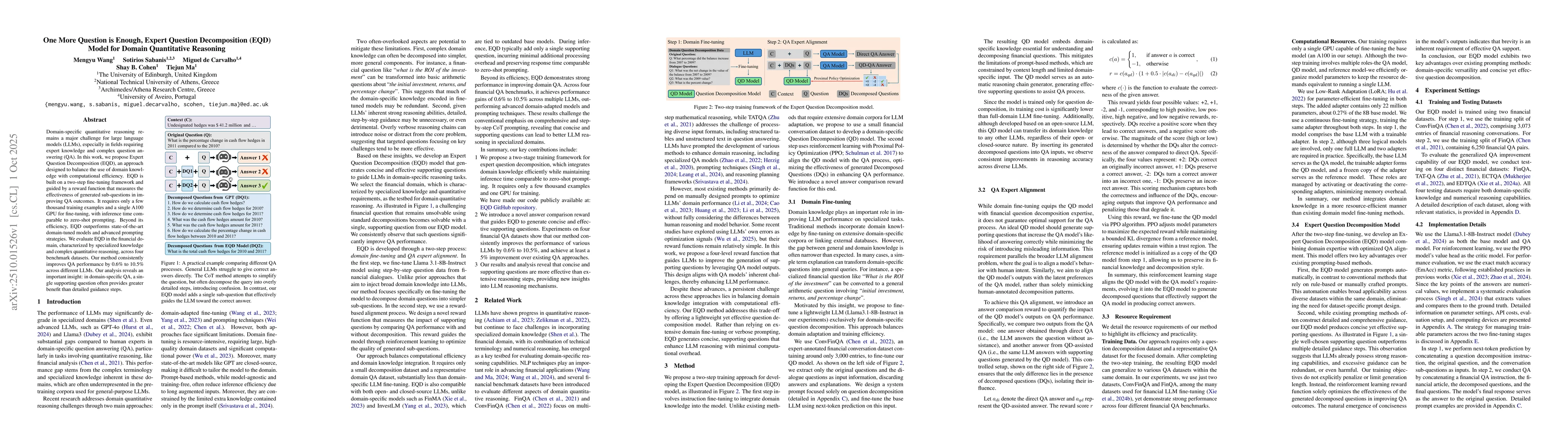

One More Question is Enough, Expert Question Decomposition (EQD) Model for Domain Quantitative Reasoning

Domain-specific quantitative reasoning remains a major challenge for large language models (LLMs), especially in fields requiring expert knowledge and complex question answering (QA). In this work, we...