Summary

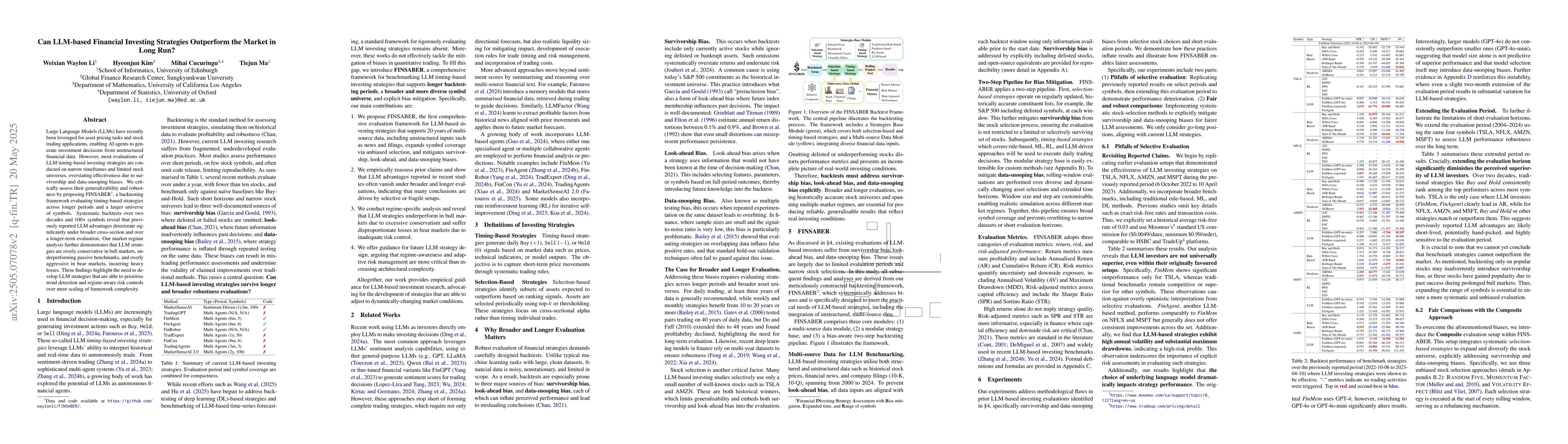

Large Language Models (LLMs) have recently been leveraged for asset pricing tasks and stock trading applications, enabling AI agents to generate investment decisions from unstructured financial data. However, most evaluations of LLM timing-based investing strategies are conducted on narrow timeframes and limited stock universes, overstating effectiveness due to survivorship and data-snooping biases. We critically assess their generalizability and robustness by proposing FINSABER, a backtesting framework evaluating timing-based strategies across longer periods and a larger universe of symbols. Systematic backtests over two decades and 100+ symbols reveal that previously reported LLM advantages deteriorate significantly under broader cross-section and over a longer-term evaluation. Our market regime analysis further demonstrates that LLM strategies are overly conservative in bull markets, underperforming passive benchmarks, and overly aggressive in bear markets, incurring heavy losses. These findings highlight the need to develop LLM strategies that are able to prioritise trend detection and regime-aware risk controls over mere scaling of framework complexity.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research proposes FINSABER, a backtesting framework for evaluating timing-based strategies across longer periods and a larger universe of symbols, systematically backtesting over two decades and 100+ symbols.

Key Results

- LLM advantages in asset pricing tasks and stock trading deteriorate significantly under broader cross-section and over a longer-term evaluation.

- LLM strategies underperform passive benchmarks in bull markets and incur heavy losses in bear markets.

- LLM strategies are found to be overly conservative in bull markets and overly aggressive in bear markets.

Significance

This research is important as it critically assesses the generalizability and robustness of LLM-based financial investing strategies, highlighting the need for strategies that prioritize trend detection and regime-aware risk controls.

Technical Contribution

FINSABER, a backtesting framework for assessing timing-based strategies across broader market conditions and longer timeframes.

Novelty

This work distinguishes itself by critically evaluating LLM-based investing strategies' effectiveness over longer periods and a larger universe of symbols, uncovering significant deterioration in reported advantages.

Limitations

- Most prior evaluations of LLM timing-based investing strategies were conducted on narrow timeframes and limited stock universes.

- Findings may be affected by survivorship and data-snooping biases not accounted for in previous studies.

Future Work

- Develop LLM strategies capable of trend detection and regime-aware risk controls.

- Expand evaluations to include more diverse datasets and longer timeframes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan Large Language Models Trade? Testing Financial Theories with LLM Agents in Market Simulations

Alejandro Lopez-Lira

Financial Markets and ESG: How Big Data is Transforming Sustainable Investing in Developing countries

A T M Omor Faruq, Md Ataur Rahman Chowdhury

No citations found for this paper.

Comments (0)