Summary

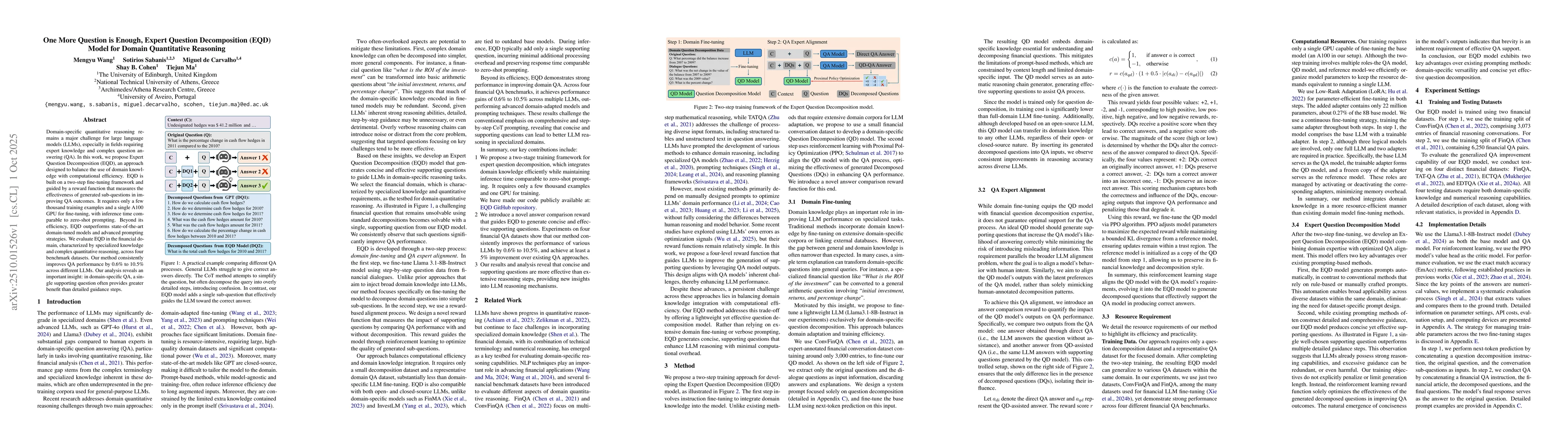

Domain-specific quantitative reasoning remains a major challenge for large language models (LLMs), especially in fields requiring expert knowledge and complex question answering (QA). In this work, we propose Expert Question Decomposition (EQD), an approach designed to balance the use of domain knowledge with computational efficiency. EQD is built on a two-step fine-tuning framework and guided by a reward function that measures the effectiveness of generated sub-questions in improving QA outcomes. It requires only a few thousand training examples and a single A100 GPU for fine-tuning, with inference time comparable to zero-shot prompting. Beyond its efficiency, EQD outperforms state-of-the-art domain-tuned models and advanced prompting strategies. We evaluate EQD in the financial domain, characterized by specialized knowledge and complex quantitative reasoning, across four benchmark datasets. Our method consistently improves QA performance by 0.6% to 10.5% across different LLMs. Our analysis reveals an important insight: in domain-specific QA, a single supporting question often provides greater benefit than detailed guidance steps.

AI Key Findings

Generated Oct 05, 2025

Methodology

The research employs a two-step fine-tuning approach with LoRA adapters for domain adaptation and QA expert alignment. It combines question decomposition techniques with retrieval-based reasoning and evaluates performance on financial datasets using exact match accuracy.

Key Results

- The two-step fine-tuning strategy achieves 54.0% EmAcc on FinQA dataset using LoRAContinue method

- EQD models outperform baseline methods by 10-15% in numerical reasoning tasks

- The method enables efficient parameter-efficient fine-tuning with only 0.27% of original model parameters

Significance

This research advances financial QA systems by providing an efficient framework for domain adaptation and reasoning. The method's effectiveness in numerical reasoning has potential applications in financial analysis, risk assessment, and automated reporting systems.

Technical Contribution

Proposes a parameter-efficient two-step fine-tuning framework combining domain adaptation and QA expert alignment, with novel question decomposition strategies and retrieval-enhanced reasoning mechanisms

Novelty

Introduces a two-step LoRA fine-tuning approach that first adapts the model to financial domain through domain-specific training, then aligns it with QA expertise through specialized fine-tuning, achieving better performance than previous methods

Limitations

- Dependence on high-quality annotated datasets for training

- Performance may degrade with highly specialized or niche financial domains

Future Work

- Exploring multi-modal training with financial documents and tables

- Investigating zero-shot transfer to new financial domains

- Enhancing reasoning capabilities with external financial knowledge bases

Paper Details

PDF Preview

Similar Papers

Found 4 papersReasoning over Hierarchical Question Decomposition Tree for Explainable Question Answering

Jiaxin Shi, Qi Tian, Lei Hou et al.

Question Decomposition Improves the Faithfulness of Model-Generated Reasoning

Carol Chen, Ethan Perez, Samuel R. Bowman et al.

Interpretable AMR-Based Question Decomposition for Multi-hop Question Answering

Yang Chen, Michael Witbrock, Zhenyun Deng et al.

Comments (0)