Summary

Risk categorization in 10-K risk disclosures matters for oversight and investment, yet no public benchmark evaluates unsupervised topic models for this task. We present GRAB, a finance-specific benchmark with 1.61M sentences from 8,247 filings and span-grounded sentence labels produced without manual annotation by combining FinBERT token attention, YAKE keyphrase signals, and taxonomy-aware collocation matching. Labels are anchored in a risk taxonomy mapping 193 terms to 21 fine-grained types nested under five macro classes; the 21 types guide weak supervision, while evaluation is reported at the macro level. GRAB unifies evaluation with fixed dataset splits and robust metrics--Accuracy, Macro-F1, Topic BERTScore, and the entropy-based Effective Number of Topics. The dataset, labels, and code enable reproducible, standardized comparison across classical, embedding-based, neural, and hybrid topic models on financial disclosures.

AI Key Findings

Generated Oct 01, 2025

Methodology

The authors developed GRAB, a benchmark dataset for unsupervised topic discovery in financial disclosures, using a combination of FinBERT token attention, YAKE keyphrase extraction, and taxonomy-aware collocation matching to generate span-grounded sentence labels without manual annotation.

Key Results

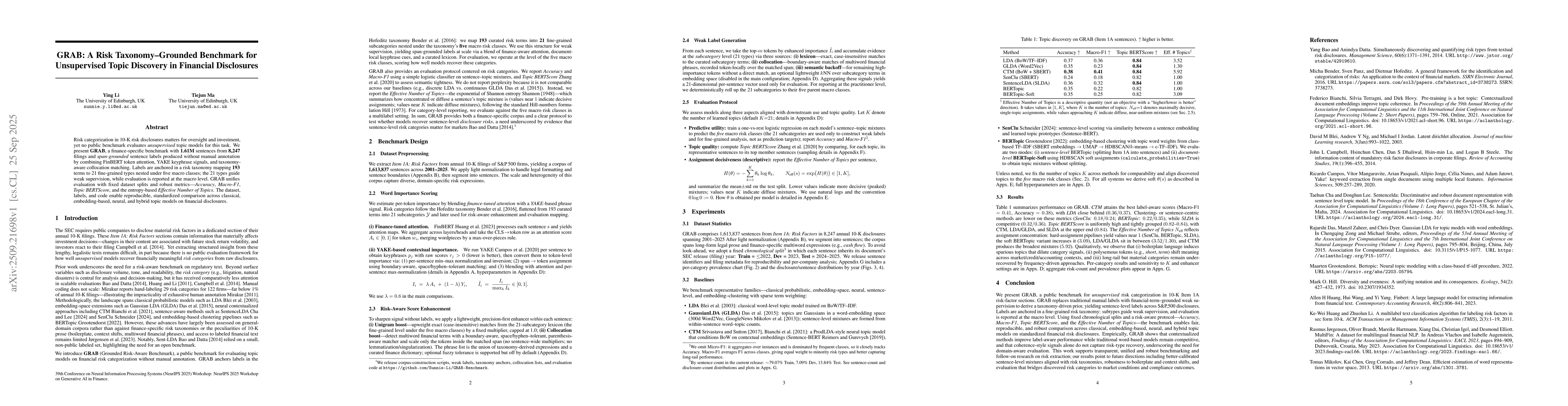

- CTM achieved the best label-aware scores with Macro-F1=0.41 and Accuracy=0.38, closely followed by LDA.

- TopicBERTScore was uniformly high across models (0.82–0.84), indicating strong semantic alignment with the risk taxonomy.

- The Effective Number of Topics (Neff) varied significantly between models, with CTM producing the broadest topic mixtures (5.92) and hard-assignment methods yielding values near 1.

Significance

GRAB provides a standardized benchmark for evaluating unsupervised topic models in financial risk categorization, enabling reproducible comparisons across diverse methods and promoting domain-aware evaluation for improved risk extraction.

Technical Contribution

GRAB introduces a finance-specific benchmark with span-grounded labels, fixed dataset splits, and robust metrics (Accuracy, Macro-F1, Topic BERTScore, and Effective Number of Topics) for standardized evaluation of topic models.

Novelty

The work introduces weakly-supervised, taxonomy-grounded labeling without manual annotation, combined with a comprehensive evaluation protocol that includes both label-aware and semantic metrics.

Limitations

- Labels are derived from weak supervision using a risk taxonomy, which may introduce biases or inaccuracies.

- Performance metrics are evaluated at the macro level, potentially overlooking fine-grained category-specific nuances.

Future Work

- Developing better-calibrated sentence-level mixtures aligned with risk taxonomies.

- Enhancing robustness to boilerplate language and context shifts in financial disclosures.

- Creating evaluation frameworks that bridge discovered risk categories to market conditions and compliance outcomes.

Paper Details

PDF Preview

Similar Papers

Found 5 papersTaxoCom: Topic Taxonomy Completion with Hierarchical Discovery of Novel Topic Clusters

Jiaming Shen, Dongha Lee, SeongKu Kang et al.

Self-supervised Topic Taxonomy Discovery in the Box Embedding Space

Qing Li, Haoran Xie, Fu Lee Wang et al.

GRAB: A Challenging GRaph Analysis Benchmark for Large Multimodal Models

Kai Han, Samuel Albanie, Jonathan Roberts

Interpretable LLMs for Credit Risk: A Systematic Review and Taxonomy

Muhammed Golec, Maha AlabdulJalil

Comments (0)