Summary

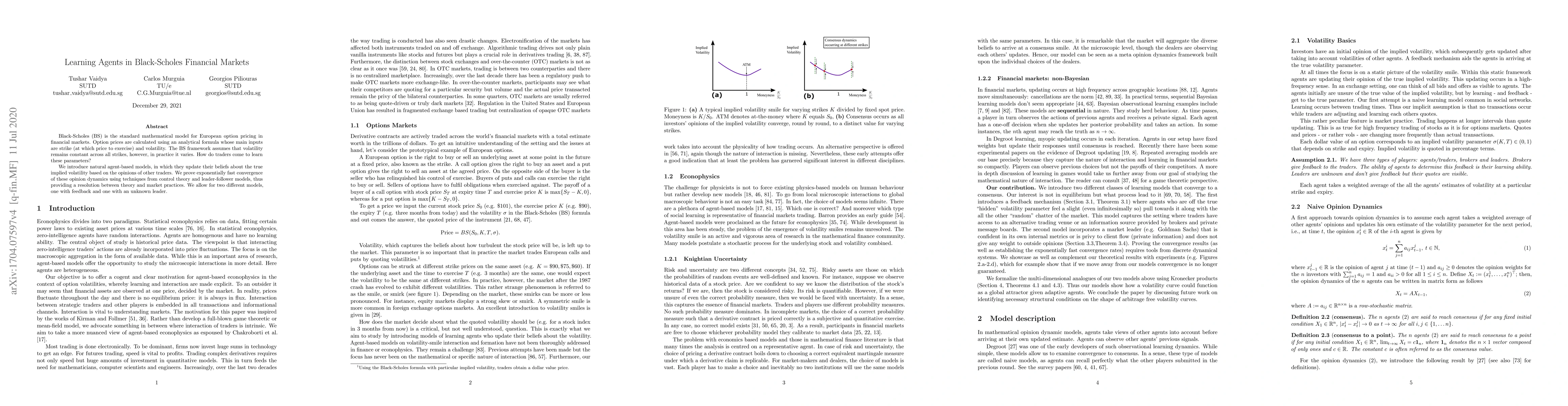

Black-Scholes (BS) is the standard mathematical model for option pricing in financial markets. Option prices are calculated using an analytical formula whose main inputs are strike (at which price to exercise) and volatility. The BS framework assumes that volatility remains constant across all strikes, however, in practice it varies. How do traders come to learn these parameters? We introduce natural models of learning agents, in which they update their beliefs about the true implied volatility based on the opinions of other traders. We prove convergence of these opinion dynamics using techniques from control theory and leader-follower models, thus providing a resolution between theory and market practices. We allow for two different models, one with feedback and one with an unknown leader.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComputing Black Scholes with Uncertain Volatility-A Machine Learning Approach

Christian Klingenberg, Kathrin Hellmuth

| Title | Authors | Year | Actions |

|---|

Comments (0)