Authors

Summary

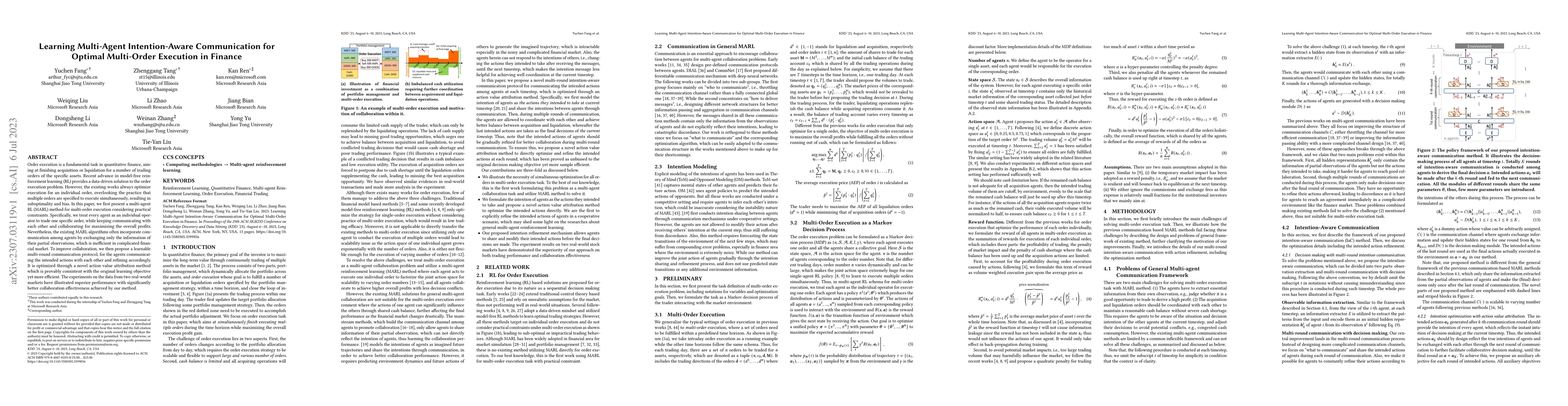

Order execution is a fundamental task in quantitative finance, aiming at finishing acquisition or liquidation for a number of trading orders of the specific assets. Recent advance in model-free reinforcement learning (RL) provides a data-driven solution to the order execution problem. However, the existing works always optimize execution for an individual order, overlooking the practice that multiple orders are specified to execute simultaneously, resulting in suboptimality and bias. In this paper, we first present a multi-agent RL (MARL) method for multi-order execution considering practical constraints. Specifically, we treat every agent as an individual operator to trade one specific order, while keeping communicating with each other and collaborating for maximizing the overall profits. Nevertheless, the existing MARL algorithms often incorporate communication among agents by exchanging only the information of their partial observations, which is inefficient in complicated financial market. To improve collaboration, we then propose a learnable multi-round communication protocol, for the agents communicating the intended actions with each other and refining accordingly. It is optimized through a novel action value attribution method which is provably consistent with the original learning objective yet more efficient. The experiments on the data from two real-world markets have illustrated superior performance with significantly better collaboration effectiveness achieved by our method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDACOM: Learning Delay-Aware Communication for Multi-Agent Reinforcement Learning

Jie Yuan, Xiaoming Fu, Tingting Yuan et al.

Context-aware Communication for Multi-agent Reinforcement Learning

Jun Zhang, Xinran Li

Learning Selective Communication for Multi-Agent Path Finding

Jia Pan, Yudong Luo, Ziyuan Ma

| Title | Authors | Year | Actions |

|---|

Comments (0)