Summary

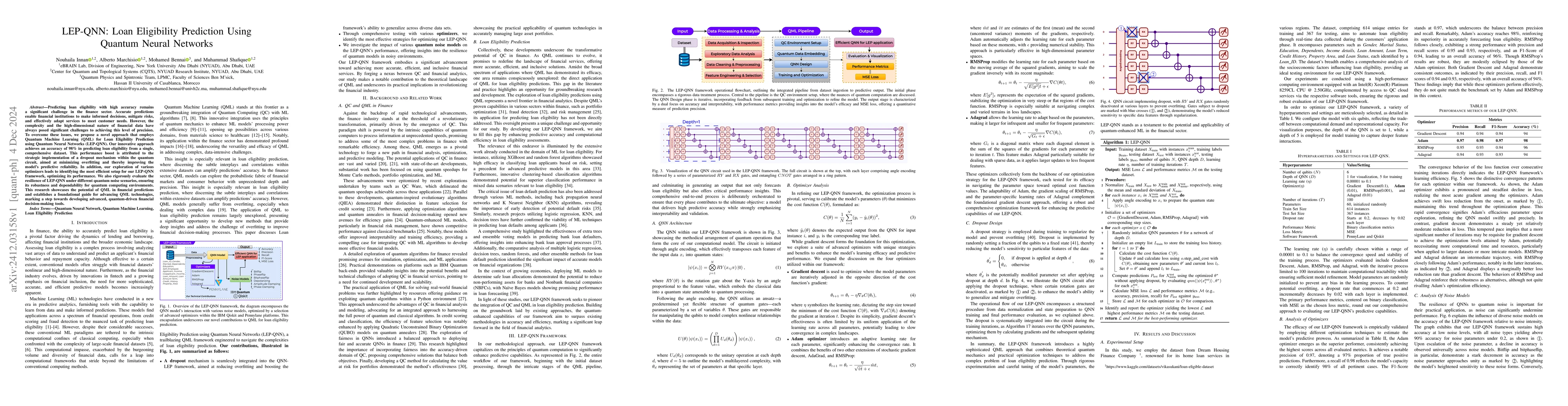

Predicting loan eligibility with high accuracy remains a significant challenge in the finance sector. Accurate predictions enable financial institutions to make informed decisions, mitigate risks, and effectively adapt services to meet customer needs. However, the complexity and the high-dimensional nature of financial data have always posed significant challenges to achieving this level of precision. To overcome these issues, we propose a novel approach that employs Quantum Machine Learning (QML) for Loan Eligibility Prediction using Quantum Neural Networks (LEP-QNN).Our innovative approach achieves an accuracy of 98% in predicting loan eligibility from a single, comprehensive dataset. This performance boost is attributed to the strategic implementation of a dropout mechanism within the quantum circuit, aimed at minimizing overfitting and thereby improving the model's predictive reliability. In addition, our exploration of various optimizers leads to identifying the most efficient setup for our LEP-QNN framework, optimizing its performance. We also rigorously evaluate the resilience of LEP-QNN under different quantum noise scenarios, ensuring its robustness and dependability for quantum computing environments. This research showcases the potential of QML in financial predictions and establishes a foundational guide for advancing QML technologies, marking a step towards developing advanced, quantum-driven financial decision-making tools.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersClassification of NEQR Processed Classical Images using Quantum Neural Networks (QNN)

Santanu Ganguly

QFDNN: A Resource-Efficient Variational Quantum Feature Deep Neural Networks for Fraud Detection and Loan Prediction

Shahid Mumtaz, Ahmed Farouk, Saif Al-Kuwari et al.

QNN-QRL: Quantum Neural Network Integrated with Quantum Reinforcement Learning for Quantum Key Distribution

Ahmed Farouk, Saif Al-Kuwari, Bikash K. Behera

QNN-VRCS: A Quantum Neural Network for Vehicle Road Cooperation Systems

Nouhaila Innan, Ahmed Farouk, Saif Al-Kuwari et al.

No citations found for this paper.

Comments (0)