Summary

Social financial technology focuses on trust, sustainability, and social responsibility, which require advanced technologies to address complex financial tasks in the digital era. With the rapid growth in online transactions, automating credit card fraud detection and loan eligibility prediction has become increasingly challenging. Classical machine learning (ML) models have been used to solve these challenges; however, these approaches often encounter scalability, overfitting, and high computational costs due to complexity and high-dimensional financial data. Quantum computing (QC) and quantum machine learning (QML) provide a promising solution to efficiently processing high-dimensional datasets and enabling real-time identification of subtle fraud patterns. However, existing quantum algorithms lack robustness in noisy environments and fail to optimize performance with reduced feature sets. To address these limitations, we propose a quantum feature deep neural network (QFDNN), a novel, resource efficient, and noise-resilient quantum model that optimizes feature representation while requiring fewer qubits and simpler variational circuits. The model is evaluated using credit card fraud detection and loan eligibility prediction datasets, achieving competitive accuracies of 82.2% and 74.4%, respectively, with reduced computational overhead. Furthermore, we test QFDNN against six noise models, demonstrating its robustness across various error conditions. Our findings highlight QFDNN potential to enhance trust and security in social financial technology by accurately detecting fraudulent transactions while supporting sustainability through its resource-efficient design and minimal computational overhead.

AI Key Findings

Generated Jun 09, 2025

Methodology

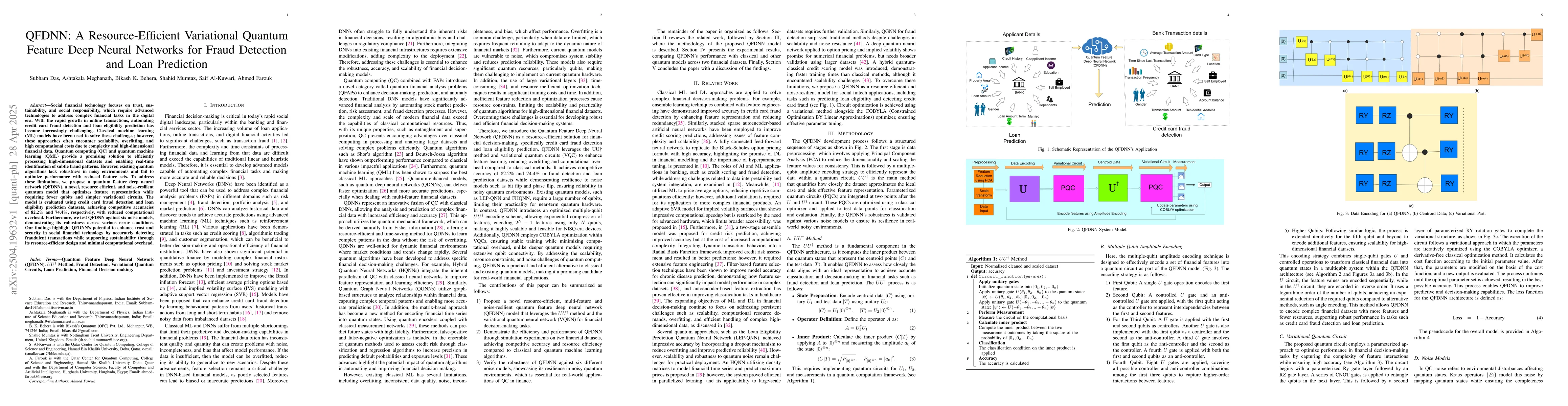

The research proposes QFDNN, a quantum feature deep neural network designed to be resource-efficient and noise-resilient, addressing limitations of existing quantum algorithms for high-dimensional financial datasets.

Key Results

- QFDNN achieves competitive accuracy of 82.2% in credit card fraud detection and 74.4% in loan eligibility prediction.

- The model demonstrates robustness across six noise models, showing performance consistency under various error conditions.

- QFDNN reduces computational overhead compared to classical ML models, enabling real-time identification of fraud patterns.

Significance

This research is significant as it enhances trust and security in social financial technology by accurately detecting fraudulent transactions and supporting sustainability through its resource-efficient design and minimal computational overhead.

Technical Contribution

The main technical contribution is the development of QFDNN, a novel quantum model that optimizes feature representation with fewer qubits and simpler variational circuits, enhancing noise resilience.

Novelty

QFDNN distinguishes itself by being resource-efficient, noise-resilient, and achieving competitive accuracy in fraud detection and loan prediction tasks, overcoming limitations of current quantum algorithms in handling high-dimensional financial data.

Limitations

- The paper does not discuss potential limitations of the QFDNN model in broader financial contexts beyond fraud detection and loan prediction.

- Specifics on the scalability of QFDNN with even larger datasets are not provided.

Future Work

- Investigate QFDNN's applicability to a wider range of financial tasks and datasets.

- Explore the scalability and performance of QFDNN with increasing dataset sizes and complexities.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Fraud Detection using Quantum Graph Neural Networks

Mohamed Bennai, Nouhaila Innan, Siddhant Dutta et al.

LEP-QNN: Loan Eligibility Prediction Using Quantum Neural Networks

Muhammad Shafique, Alberto Marchisio, Mohamed Bennai et al.

Efficient Fraud Detection Using Deep Boosting Decision Trees

Yao Wang, Kaidong Wang, Biao Xu et al.

No citations found for this paper.

Comments (0)