Summary

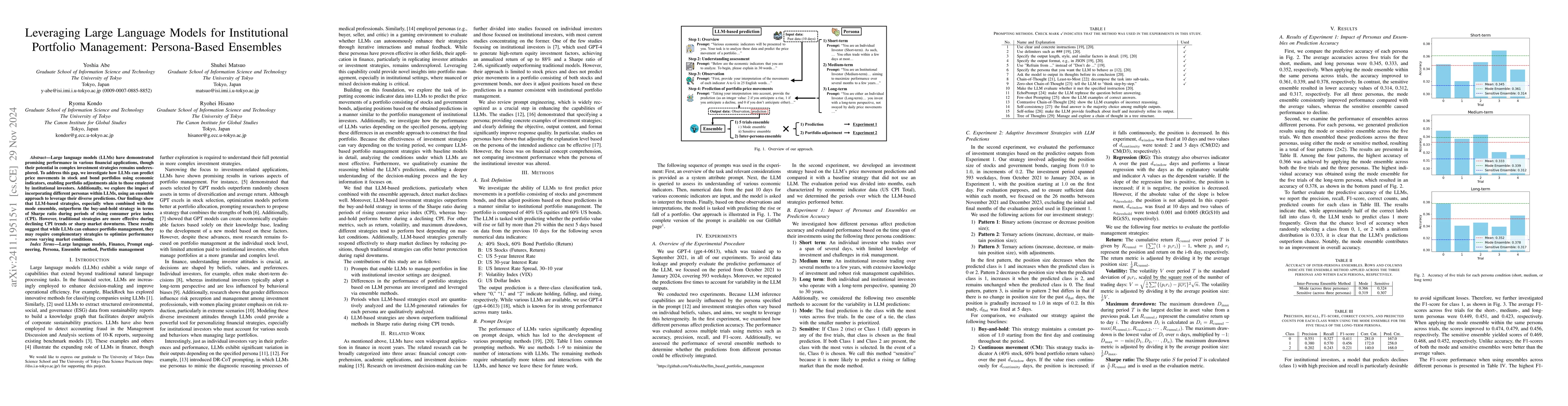

Large language models (LLMs) have demonstrated promising performance in various financial applications, though their potential in complex investment strategies remains underexplored. To address this gap, we investigate how LLMs can predict price movements in stock and bond portfolios using economic indicators, enabling portfolio adjustments akin to those employed by institutional investors. Additionally, we explore the impact of incorporating different personas within LLMs, using an ensemble approach to leverage their diverse predictions. Our findings show that LLM-based strategies, especially when combined with the mode ensemble, outperform the buy-and-hold strategy in terms of Sharpe ratio during periods of rising consumer price index (CPI). However, traditional strategies are more effective during declining CPI trends or sharp market downturns. These results suggest that while LLMs can enhance portfolio management, they may require complementary strategies to optimize performance across varying market conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFaithful Persona-based Conversational Dataset Generation with Large Language Models

Jay Pujara, XiangHai Sheng, Xinyi Bai et al.

Intent-Based Network for RAN Management with Large Language Models

Edwin K. P. Chong, Ray-Guang Cheng, Fransiscus Asisi Bimo et al.

Empowering AIOps: Leveraging Large Language Models for IT Operations ManagementOperations Management

Tse-Hsun Chen, Arthur Vitui

Boosted Prompt Ensembles for Large Language Models

Jimmy Ba, Michael R. Zhang, Silviu Pitis et al.

No citations found for this paper.

Comments (0)