Summary

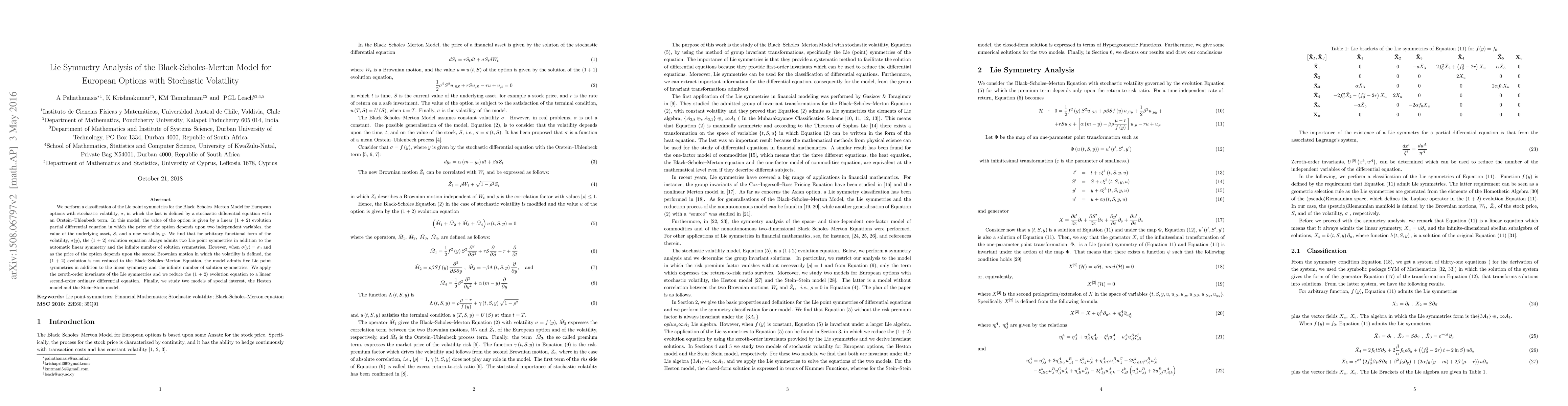

We perform a classification of the Lie point symmetries for the Black--Scholes--Merton Model for European options with stochastic volatility, $\sigma$, in which the last is defined by a stochastic differential equation with an Orstein--Uhlenbeck term. In this model, the value of the option is given by a linear (1 + 2) evolution partial differential equation in which the price of the option depends upon two independent variables, the value of the underlying asset, $S$, and a new variable, $y$. We find that for arbitrary functional form of the volatility, $\sigma(y)$, the (1 + 2) evolution equation always admits two Lie point symmetries in addition to the automatic linear symmetry and the infinite number of solution symmetries. However, when $\sigma(y)=\sigma_{0}$ and as the price of the option depends upon the second Brownian motion in which the volatility is defined, the (1 + 2) evolution is not reduced to the Black--Scholes--Merton Equation, the model admits five Lie point symmetries in addition to the linear symmetry and the infinite number of solution symmetries. We apply the zeroth-order invariants of the Lie symmetries and we reduce the (1 + 2) evolution equation to a linear second-order ordinary differential equation. Finally, we study two models of special interest, the Heston model and the Stein--Stein model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSymmetries of the Black-Scholes-Merton equation for European options

Landysh N. Bakirova, Marina A. Shurygina, Vadim V. Shurygin, Jr

| Title | Authors | Year | Actions |

|---|

Comments (0)