Authors

Summary

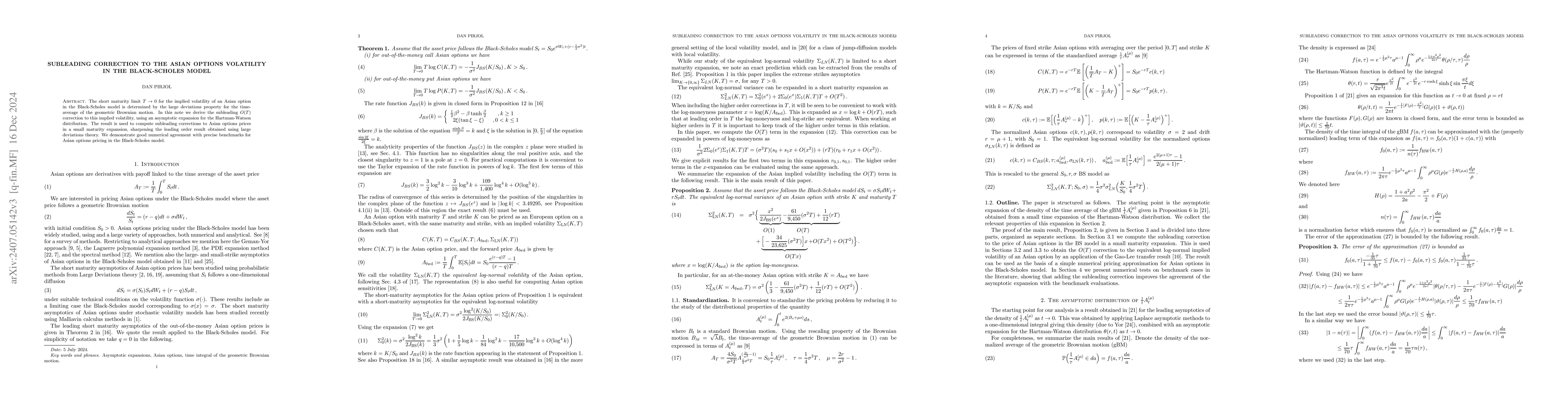

The short maturity limit $T\to 0$ for the implied volatility of an Asian option in the Black-Scholes model is determined by the large deviations property for the time-average of the geometric Brownian motion. In this note we derive the subleading $O(T)$ correction to this implied volatility, using an asymptotic expansion for the Hartman-Watson distribution. The result is used to compute subleading corrections to Asian options prices in a small maturity expansion, sharpening the leading order result obtained using large deviations theory. We demonstrate good numerical agreement with precise benchmarks for Asian options pricing in the Black-Scholes model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersSensitivities of Asian options in the Black-Scholes model

Dan Pirjol, Lingjiong Zhu

On the implied volatility of Asian options under stochastic volatility models

Elisa Alòs, Eulalia Nualart, Makar Pravosud

No citations found for this paper.

Comments (0)