Authors

Summary

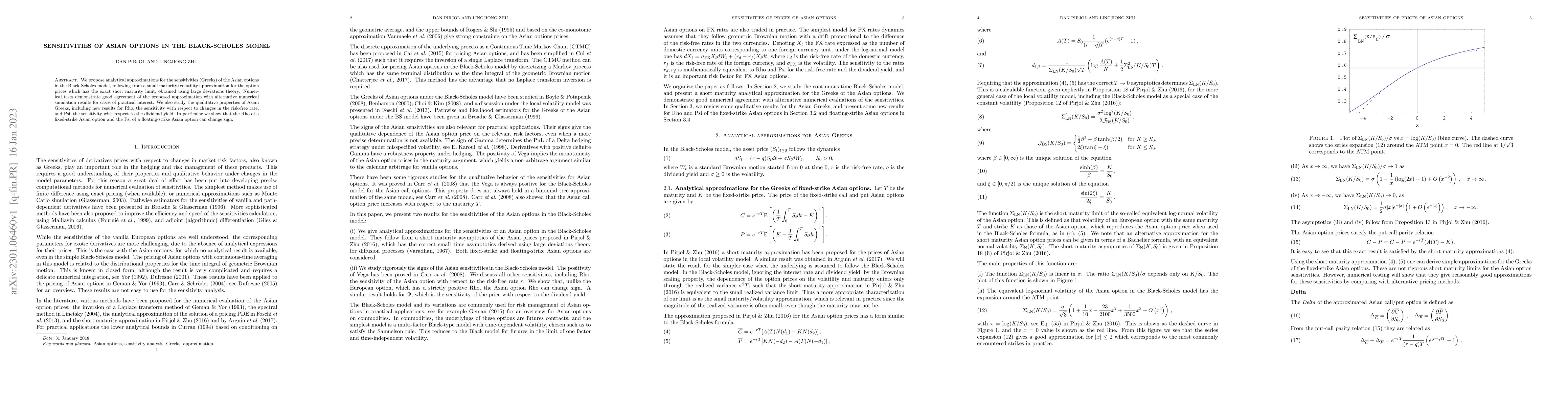

We propose analytical approximations for the sensitivities (Greeks) of the Asian options in the Black-Scholes model, following from a small maturity/volatility approximation for the option prices which has the exact short maturity limit, obtained using large deviations theory. Numerical tests demonstrate good agreement of the proposed approximation with alternative numerical simulation results for cases of practical interest. We also study the qualitative properties of Asian Greeks, including new results for Rho, the sensitivity with respect to changes in the risk-free rate, and Psi, the sensitivity with respect to the dividend yield. In particular we show that the Rho of a fixed-strike Asian option and the Psi of a floating-strike Asian option can change sign.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)