Lingjiong Zhu

36 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

A State-Dependent Dual Risk Model

In a dual risk model, the premiums are considered as the costs and the claims are regarded as the profits. The surplus can be interpreted as the wealth of a venture capital, whose profits depend on ...

Optimal Investment in a Dual Risk Model

Dual risk models are popular for modeling a venture capital or high tech company, for which the running cost is deterministic and the profits arrive stochastically over time. Most of the existing li...

Asymptotic Analysis for Optimal Dividends in a Dual Risk Model

The dual risk model is a popular model in finance and insurance, which is often used to model the wealth process of a venture capital or high tech company. Optimal dividends have been extensively st...

Approximate Variational Estimation for a Model of Network Formation

We develop approximate estimation methods for exponential random graph models (ERGMs), whose likelihood is proportional to an intractable normalizing constant. The usual approach approximates this c...

Differential Privacy of Noisy (S)GD under Heavy-Tailed Perturbations

Injecting heavy-tailed noise to the iterates of stochastic gradient descent (SGD) has received increasing attention over the past few years. While various theoretical properties of the resulting alg...

Short-maturity asymptotics for option prices with interest rates effects

We derive the short-maturity asymptotics for option prices in the local volatility model in a new short-maturity limit $T\to 0$ at fixed $\rho = (r-q) T$, where $r$ is the interest rate and $q$ is t...

Euler-Maruyama schemes for stochastic differential equations driven by stable L\'{e}vy processes with i.i.d. stable components

We study Euler-Maruyama numerical schemes of stochastic differential equations driven by stable L\'{e}vy processes with i.i.d. stable components. We obtain a uniform-in-time approximation error in W...

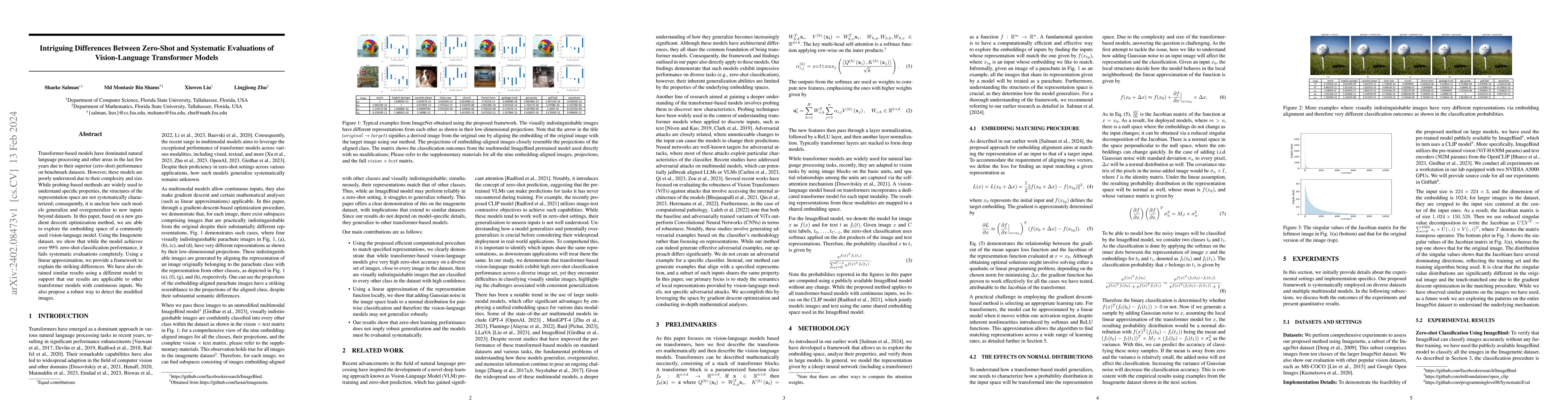

Intriguing Differences Between Zero-Shot and Systematic Evaluations of Vision-Language Transformer Models

Transformer-based models have dominated natural language processing and other areas in the last few years due to their superior (zero-shot) performance on benchmark datasets. However, these models a...

Convergence Analysis for General Probability Flow ODEs of Diffusion Models in Wasserstein Distances

Score-based generative modeling with probability flow ordinary differential equations (ODEs) has achieved remarkable success in a variety of applications. While various fast ODE-based samplers have ...

Wasserstein Convergence Guarantees for a General Class of Score-Based Generative Models

Score-based generative models (SGMs) is a recent class of deep generative models with state-of-the-art performance in many applications. In this paper, we establish convergence guarantees for a gene...

Asymptotics for Short Maturity Asian Options in Jump-Diffusion models with Local Volatility

We present a study of the short maturity asymptotics for Asian options in a jump-diffusion model with a local volatility component, where the jumps are modeled as a compound Poisson process. The ana...

Fluctuations and moderate deviations for the mean fields of Hawkes processes

The Hawkes process is a counting process that has self- and mutually-exciting features with many applications in various fields. In recent years, there have been many interests in the mean-field res...

Asymptotics for the Laplace transform of the time integral of the geometric Brownian motion

We present an asymptotic result for the Laplace transform of the time integral of the geometric Brownian motion $F(\theta,T) = \mathbb{E}[e^{-\theta X_T}]$ with $X_T = \int_0^T e^{\sigma W_s + ( a -...

Uniform-in-Time Wasserstein Stability Bounds for (Noisy) Stochastic Gradient Descent

Algorithmic stability is an important notion that has proven powerful for deriving generalization bounds for practical algorithms. The last decade has witnessed an increasing number of stability bou...

Cyclic and Randomized Stepsizes Invoke Heavier Tails in SGD than Constant Stepsize

Cyclic and randomized stepsizes are widely used in the deep learning practice and can often outperform standard stepsize choices such as constant stepsize in SGD. Despite their empirical success, no...

Algorithmic Stability of Heavy-Tailed SGD with General Loss Functions

Heavy-tail phenomena in stochastic gradient descent (SGD) have been reported in several empirical studies. Experimental evidence in previous works suggests a strong interplay between the heaviness o...

Large deviations for the mean-field limit of Hawkes processes

Hawkes processes are a class of simple point processes whose intensity depends on the past history, and is in general non-Markovian. Limit theorems for Hawkes processes in various asymptotic regimes...

Sensitivities of Asian options in the Black-Scholes model

We propose analytical approximations for the sensitivities (Greeks) of the Asian options in the Black-Scholes model, following from a small maturity/volatility approximation for the option prices wh...

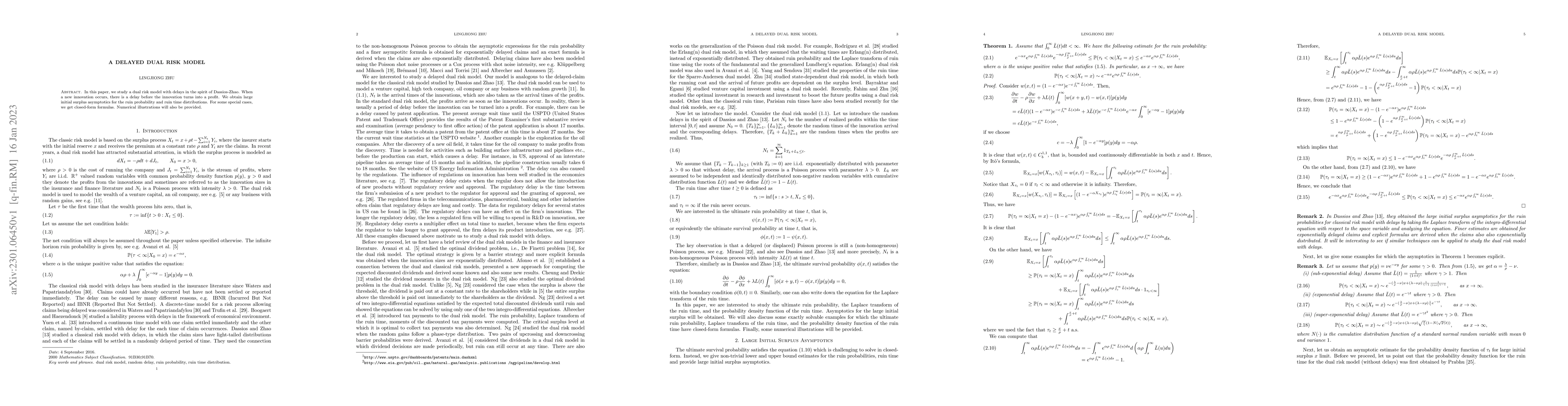

A delayed dual risk model

In this paper, we study a dual risk model with delays in the spirit of Dassios-Zhao. When a new innovation occurs, there is a delay before the innovation turns into a profit. We obtain large initial...

Penalized Overdamped and Underdamped Langevin Monte Carlo Algorithms for Constrained Sampling

We consider the constrained sampling problem where the goal is to sample from a target distribution $\pi(x)\propto e^{-f(x)}$ when $x$ is constrained to lie on a convex body $\mathcal{C}$. Motivated...

Algorithmic Stability of Heavy-Tailed Stochastic Gradient Descent on Least Squares

Recent studies have shown that heavy tails can emerge in stochastic optimization and that the heaviness of the tails have links to the generalization error. While these studies have shed light on in...

Heavy-Tail Phenomenon in Decentralized SGD

Recent theoretical studies have shown that heavy-tails can emerge in stochastic optimization due to `multiplicative noise', even under surprisingly simple settings, such as linear regression with Ga...

Generalized EXTRA stochastic gradient Langevin dynamics

Langevin algorithms are popular Markov Chain Monte Carlo methods for Bayesian learning, particularly when the aim is to sample from the posterior distribution of a parametric model, given the input da...

Short-maturity options on realized variance in local-stochastic volatility models

We derive the short-maturity asymptotics for prices of options on realized variance in local-stochastic volatility models. We consider separately the short-maturity asymptotics for out-of-the-money an...

Short-maturity Asian options in local-stochastic volatility models

We derive the short-maturity asymptotics for Asian option prices in local-stochastic volatility (LSV) models. Both out-of-the-money (OTM) and at-the-money (ATM) asymptotics are considered. Using large...

Short-maturity asymptotics for VIX and European options in local-stochastic volatility models

We derive the short-maturity asymptotics for European and VIX option prices in local-stochastic volatility models where the volatility follows a continuous-path Markov process. Both out-of-the-money (...

VIX options in the SABR model

We study the pricing of VIX options in the SABR model $dS_t = \sigma_t S_t^\beta dB_t, d\sigma_t = \omega \sigma_t dZ_t$ where $B_t,Z_t$ are standard Brownian motions correlated with correlation $\rho...

Non-Reversible Langevin Algorithms for Constrained Sampling

We consider the constrained sampling problem where the goal is to sample from a target distribution on a constrained domain. We propose skew-reflected non-reversible Langevin dynamics (SRNLD), a conti...

Algorithmic Stability of Stochastic Gradient Descent with Momentum under Heavy-Tailed Noise

Understanding the generalization properties of optimization algorithms under heavy-tailed noise has gained growing attention. However, the existing theoretical results mainly focus on stochastic gradi...

BRIDLE: Generalized Self-supervised Learning with Quantization

Self-supervised learning has been a powerful approach for learning meaningful representations from unlabeled data across various domains, reducing the reliance on large labeled datasets. Inspired by B...

Accelerating Langevin Monte Carlo Sampling: A Large Deviations Analysis

Langevin algorithms are popular Markov chain Monte Carlo methods that are often used to solve high-dimensional large-scale sampling problems in machine learning. The most classical Langevin Monte Carl...

Accelerating Constrained Sampling: A Large Deviations Approach

The problem of sampling a target probability distribution on a constrained domain arises in many applications including machine learning. For constrained sampling, various Langevin algorithms such as ...

Sequencing, task failures, and capacity when failures are driven by a non-homogeneous Poisson process

We study the optimal sequencing of a batch of tasks on a machine subject to random disruptions driven by a non-homogeneous Poisson process (NHPP), such that every disruption requires the interrupted t...

Regime-Switching Langevin Monte Carlo Algorithms

Langevin Monte Carlo (LMC) algorithms are popular Markov Chain Monte Carlo (MCMC) methods to sample a target probability distribution, which arises in many applications in machine learning. Inspired b...

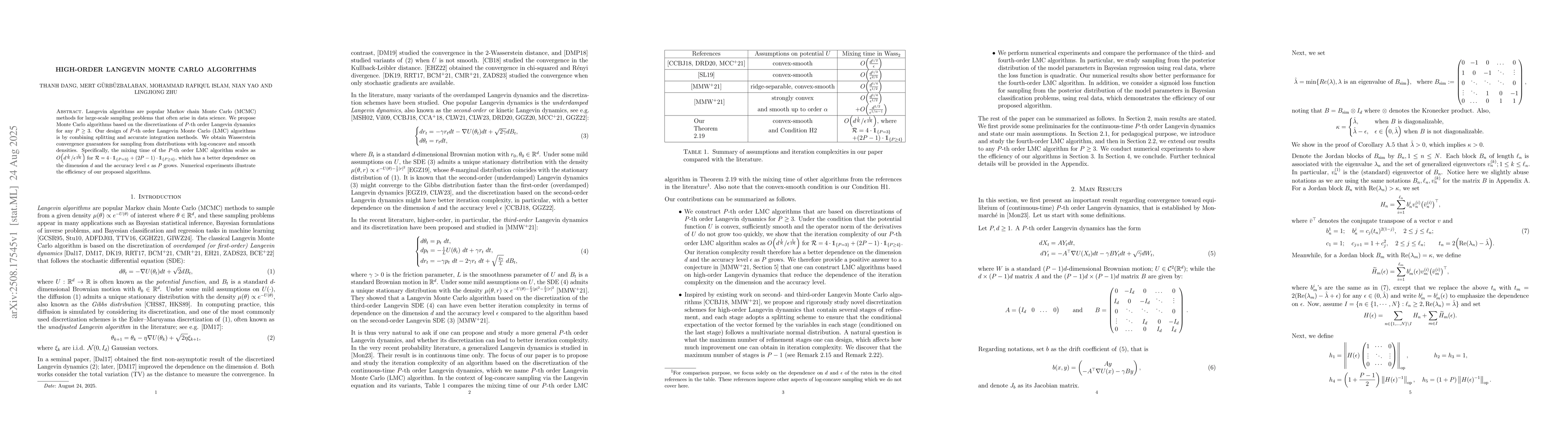

High-Order Langevin Monte Carlo Algorithms

Langevin algorithms are popular Markov chain Monte Carlo (MCMC) methods for large-scale sampling problems that often arise in data science. We propose Monte Carlo algorithms based on the discretizatio...

Anchored Langevin Algorithms

Standard first-order Langevin algorithms such as the unadjusted Langevin algorithm (ULA) are obtained by discretizing the Langevin diffusion and are widely used for sampling in machine learning becaus...