Authors

Summary

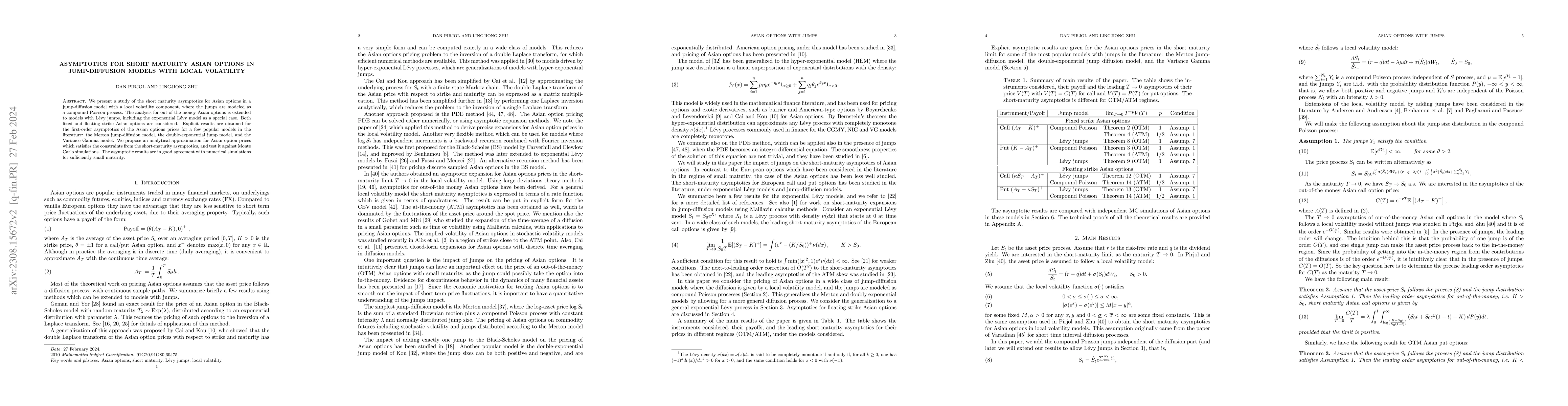

We present a study of the short maturity asymptotics for Asian options in a jump-diffusion model with a local volatility component, where the jumps are modeled as a compound Poisson process. The analysis for out-of-the-money Asian options is extended to models with L\'evy jumps, including the exponential L\'{e}vy model as a special case. Both fixed and floating strike Asian options are considered. Explicit results are obtained for the first-order asymptotics of the Asian options prices for a few popular models in the literature: the Merton jump-diffusion model, the double-exponential jump model, and the Variance Gamma model. We propose an analytical approximation for Asian option prices which satisfies the constraints from the short-maturity asymptotics, and test it against Monte Carlo simulations. The asymptotic results are in good agreement with numerical simulations for sufficiently small maturity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShort-maturity Asian options in local-stochastic volatility models

Dan Pirjol, Lingjiong Zhu

Some asymptotics for short maturity Asian options

Indranil SenGupta, Humayra Shoshi

Pricing and hedging short-maturity Asian options in local volatility models

Jaehyun Kim, Hyungbin Park, Jonghwa Park

| Title | Authors | Year | Actions |

|---|

Comments (0)