Authors

Summary

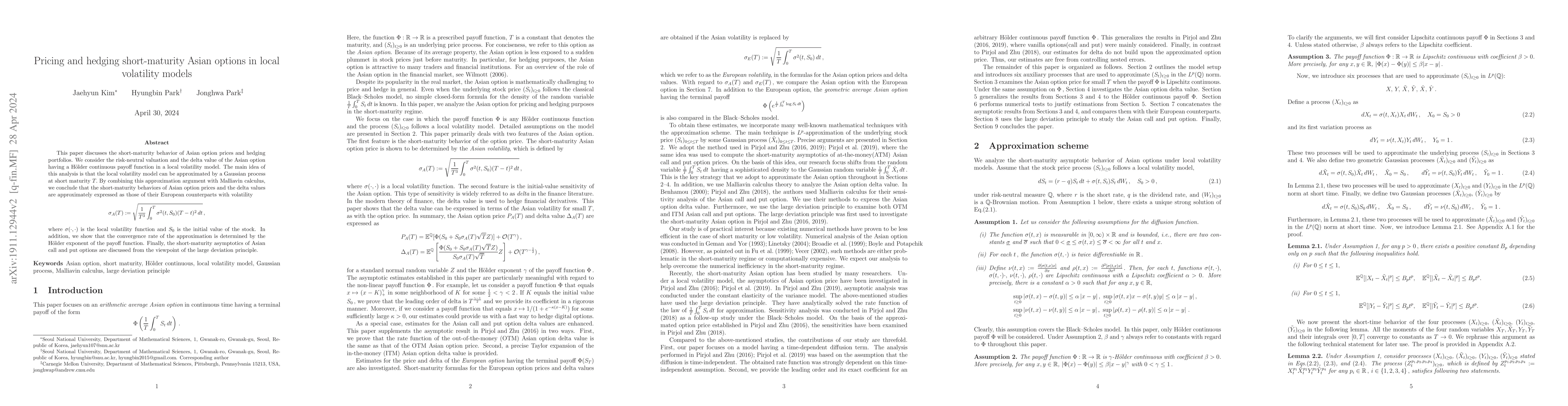

This paper discusses the short-maturity behavior of Asian option prices and hedging portfolios. We consider the risk-neutral valuation and the delta value of the Asian option having a H\"older continuous payoff function in a local volatility model. The main idea of this analysis is that the local volatility model can be approximated by a Gaussian process at short maturity $T.$ By combining this approximation argument with Malliavin calculus, we conclude that the short-maturity behaviors of Asian option prices and the delta values are approximately expressed as those of their European counterparts with volatility $$\sigma_{A}(T):=\sqrt{\frac{1}{T^3}\int_0^T\sigma^2(t,S_0)(T-t)^2\,dt}\,,$$ where $\sigma(\cdot,\cdot)$ is the local volatility function and $S_0$ is the initial value of the stock. In addition, we show that the convergence rate of the approximation is determined by the H\"older exponent of the payoff function. Finally, the short-maturity asymptotics of Asian call and put options are discussed from the viewpoint of the large deviation principle.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShort-maturity Asian options in local-stochastic volatility models

Dan Pirjol, Lingjiong Zhu

Asymptotics for Short Maturity Asian Options in Jump-Diffusion models with Local Volatility

Dan Pirjol, Lingjiong Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)