Summary

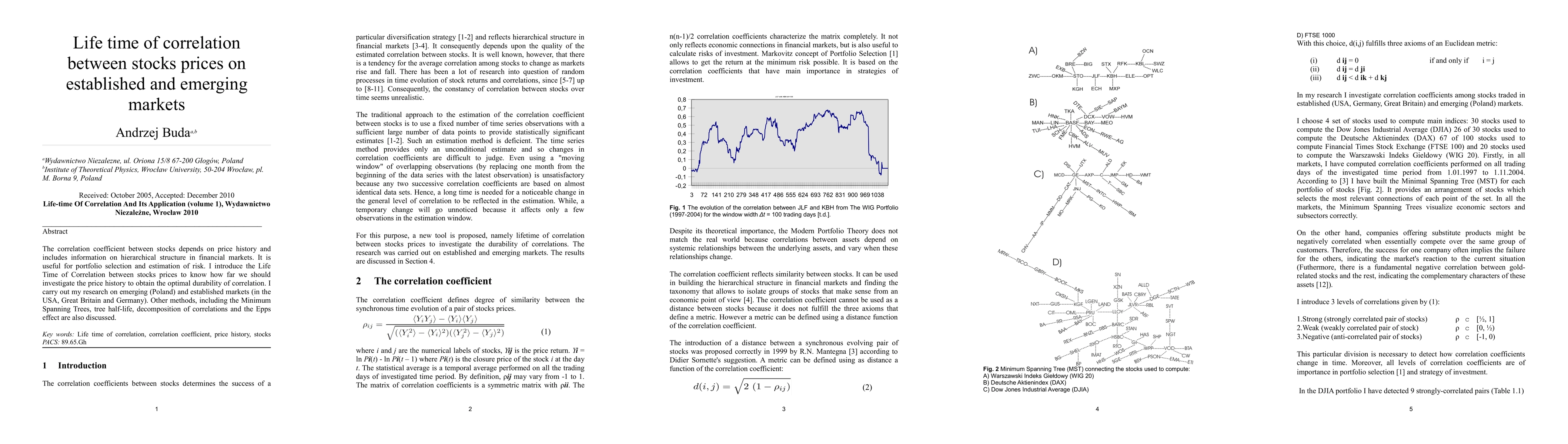

The correlation coefficient between stocks depends on price history and includes information on hierarchical structure in financial markets. It is useful for portfolio selection and estimation of risk. I introduce the Life Time of Correlation between stocks prices to know how far we should investigate the price history to obtain the optimal durability of correlation. I carry out my research on emerging (Poland) and established markets (in the USA, Great Britain and Germany). Other methods, including the Minimum Spanning Trees, tree half-life, decomposition of correlations and the Epps effect are also discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)