Summary

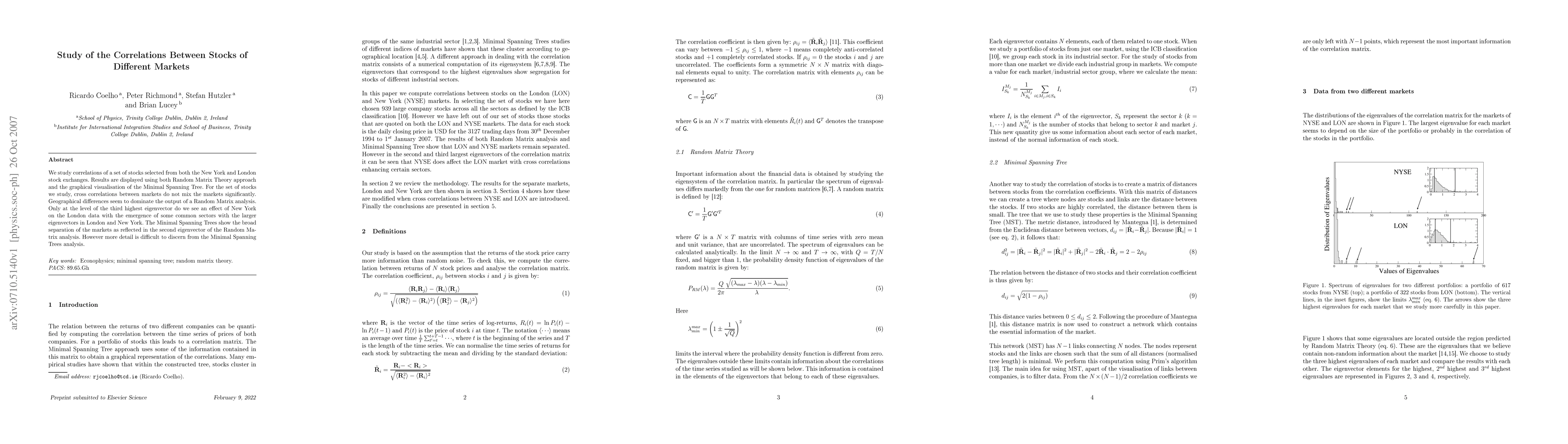

We study correlations of a set of stocks selected from both the New York and London stock exchanges. Results are displayed using both Random Matrix Theory approach and the graphical visualisation of the Minimal Spanning Tree. For the set of stocks we study, cross correlations between markets do not mix the markets significantly. Geographical differences seem to dominate the output of a Random Matrix analysis. Only at the level of the third highest eigenvector do we see an effect of New York on the London data with the emergence of some common sectors with the larger eigenvectors in London and New York. The Minimal Spanning Trees show the broad separation of the markets as reflected in the second eigenvector of the Random Matrix analysis. However more detail is difficult to discern from the Minimal Spanning Trees analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)