Summary

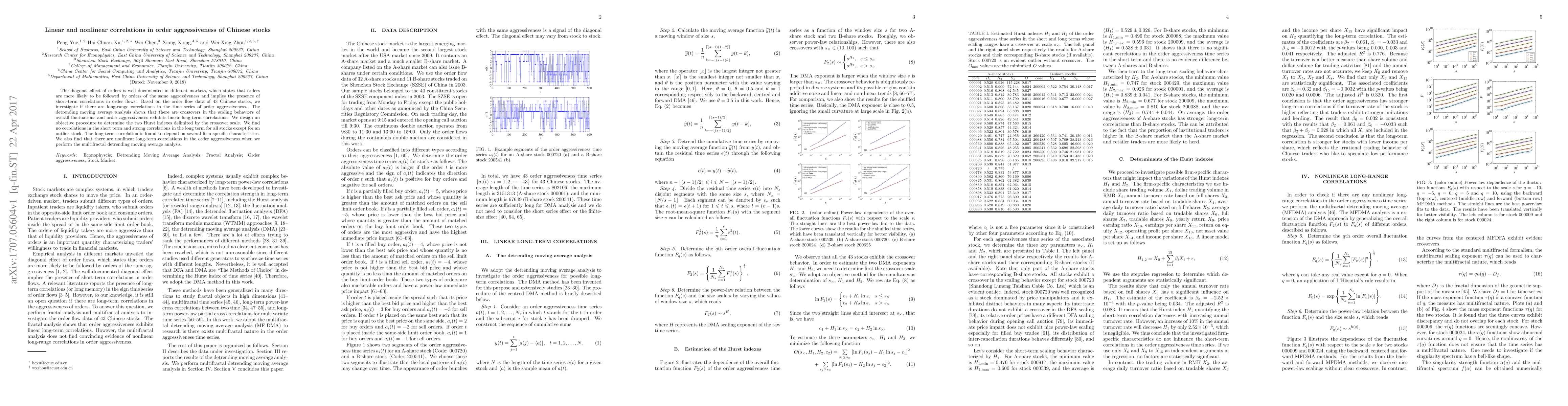

The diagonal effect of orders is well documented in different markets, which states that orders are more likely to be followed by orders of the same aggressiveness and implies the presence of short-term correlations in order flows. Based on the order flow data of 43 Chinese stocks, we investigate if there are long-range correlations in the time series of order aggressiveness. The detrending moving average analysis shows that there are crossovers in the scaling behaviors of overall fluctuations and order aggressiveness exhibits linear long-term correlations. We design an objective procedure to determine the two Hurst indexes delimited by the crossover scale. We find no correlations in the short term and strong correlations in the long term for all stocks except for an outlier stock. The long-term correlation is found to depend on several firm specific characteristics. We also find that there are nonlinear long-term correlations in the order aggressiveness when we perform the multifractal detrending moving average analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)