Summary

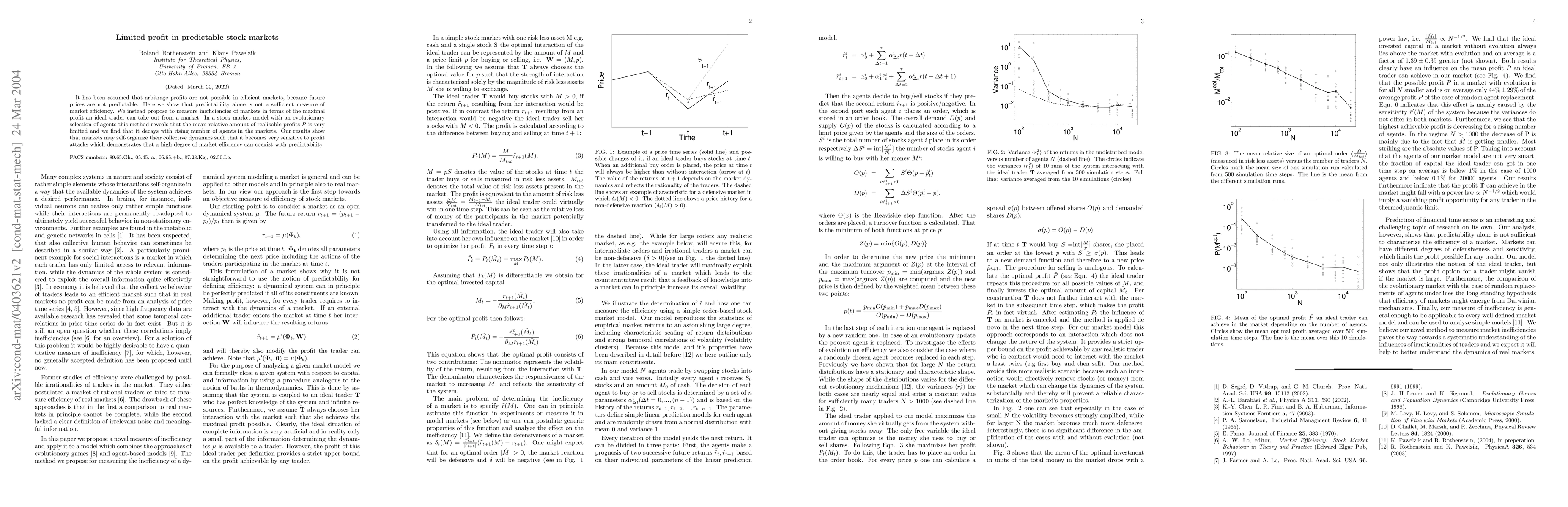

It has been assumed that arbitrage profits are not possible in efficient markets, because future prices are not predictable. Here we show that predictability alone is not a sufficient measure of market efficiency. We instead propose to measure inefficiencies of markets in terms of the maximal profit an ideal trader can take out from a market. In a stock market model with an evolutionary selection of agents this method reveals that the mean relative amount of realizable profits $P$ is very limited and we find that it decays with rising number of agents in the markets. Our results show that markets may self-organize their collective dynamics such that it becomes very sensitive to profit attacks which demonstrates that a high degree of market efficiency can coexist with predictability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)