Summary

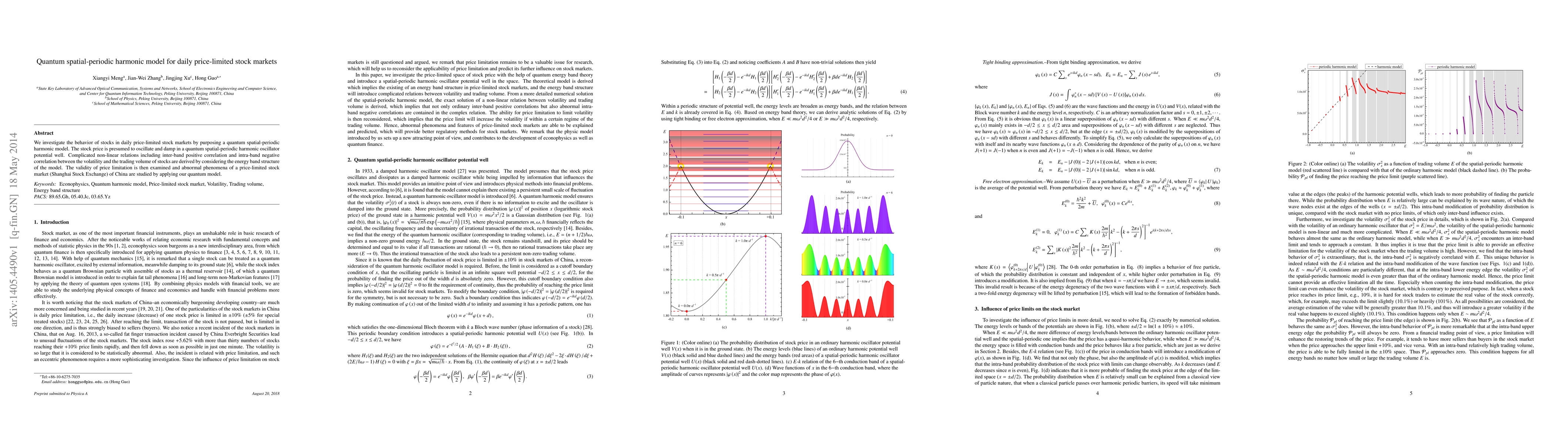

We investigate the behavior of stocks in daily price-limited stock markets by purposing a quantum spatial-periodic harmonic model. The stock price is presumed to oscillate and damp in a quantum spatial-periodic harmonic oscillator potential well. Complicated non-linear relations including inter-band positive correlation and intra-band negative correlation between the volatility and the trading volume of stocks are derived by considering the energy band structure of the model. The validity of price limitation is then examined and abnormal phenomena of a price-limited stock market (Shanghai Stock Exchange) of China are studied by applying our quantum model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)