Authors

Summary

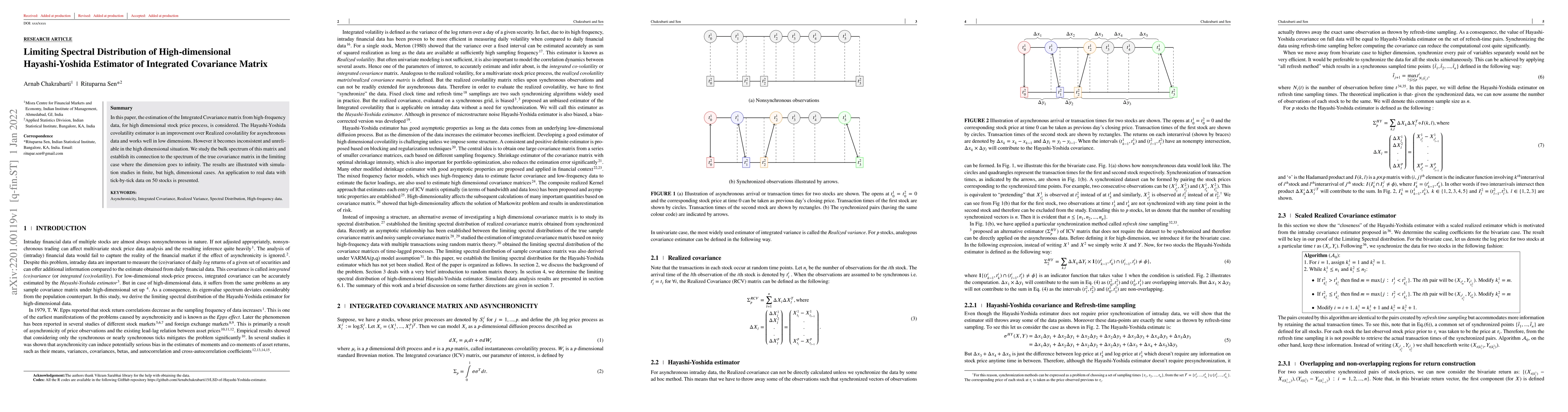

In this paper, the estimation of the Integrated Covariance matrix from high-frequency data, for high dimensional stock price process, is considered. The Hayashi-Yoshida covolatility estimator is an improvement over Realized covolatility for asynchronous data and works well in low dimensions. However it becomes inconsistent and unreliable in the high dimensional situation. We study the bulk spectrum of this matrix and establish its connection to the spectrum of the true covariance matrix in the limiting case where the dimension goes to infinity. The results are illustrated with simulation studies in finite, but high, dimensional cases. An application to real data with tick-by-tick data on 50 stocks is presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)