Summary

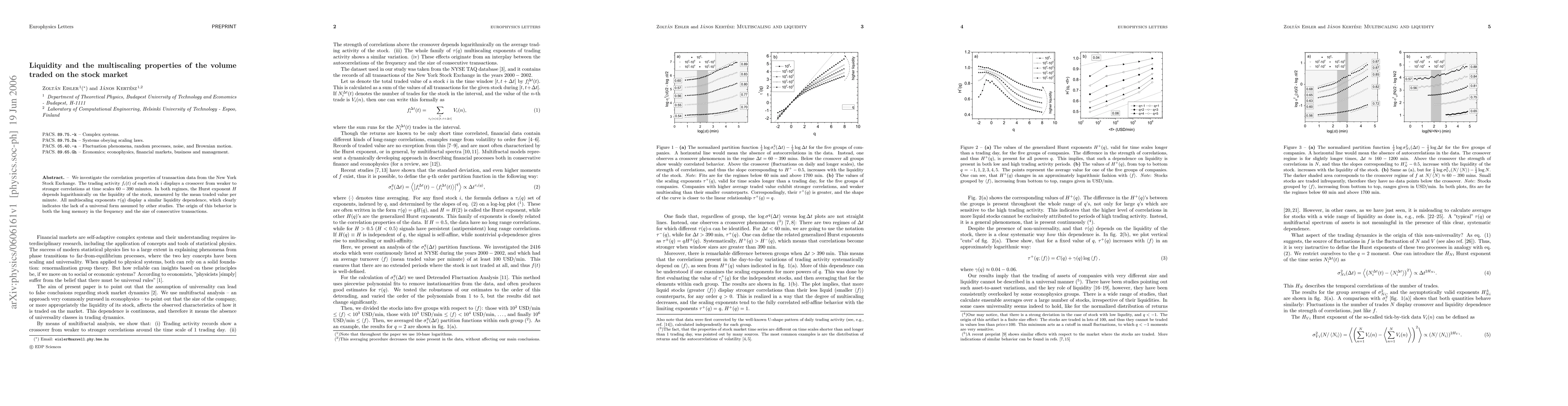

We investigate the correlation properties of transaction data from the New York Stock Exchange. The trading activity f(t) of each stock displays a crossover from weaker to stronger correlations at time scales 60-390 minutes. In both regimes, the Hurst exponent H depends logarithmically on the liquidity of the stock, measured by the mean traded value per minute. All multiscaling exponents tau(q) display a similar liquidity dependence, which clearly indicates the lack of a universal form assumed by other studies. The origin of this behavior is both the long memory in the frequency and the size of consecutive transactions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)