Summary

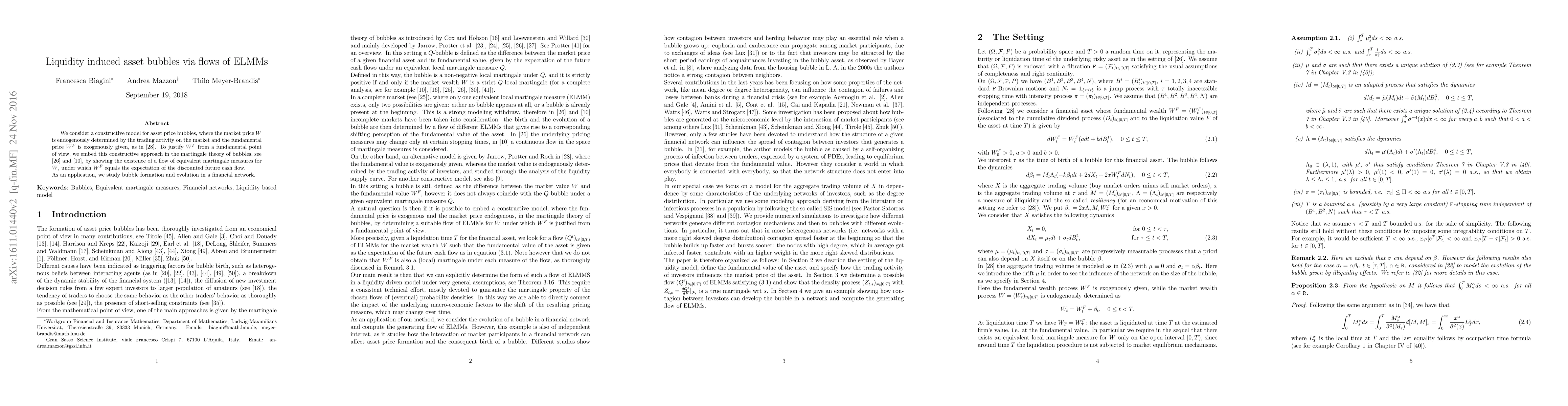

We consider a constructive model for asset price bubbles, where the market price $W$ is endogenously determined by the trading activity on the market and the fundamental price $W^F$ is exogenously given, as in the work of Jarrow, Protter and Roch (2012). To justify $W^F$ from a fundamental point of view, we embed this constructive approach in the martingale theory of bubbles, see Jarrow, Protter and Shimbo (2010) and Biagini, F\"ollmer and Nedelcu (2014), by showing the existence of a flow of equivalent martingale measures for $W$, under which $W^F$ equals the expectation of the discounted future cash flow. As an application, we study bubble formation and evolution in a financial network.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity based modeling of asset price bubbles via random matching

Francesca Biagini, Andrea Mazzon, Thilo Meyer-Brandis et al.

Supplement Liquidity based modeling of asset price bubbles via random matching

Francesca Biagini, Andrea Mazzon, Thilo Meyer-Brandis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)