Summary

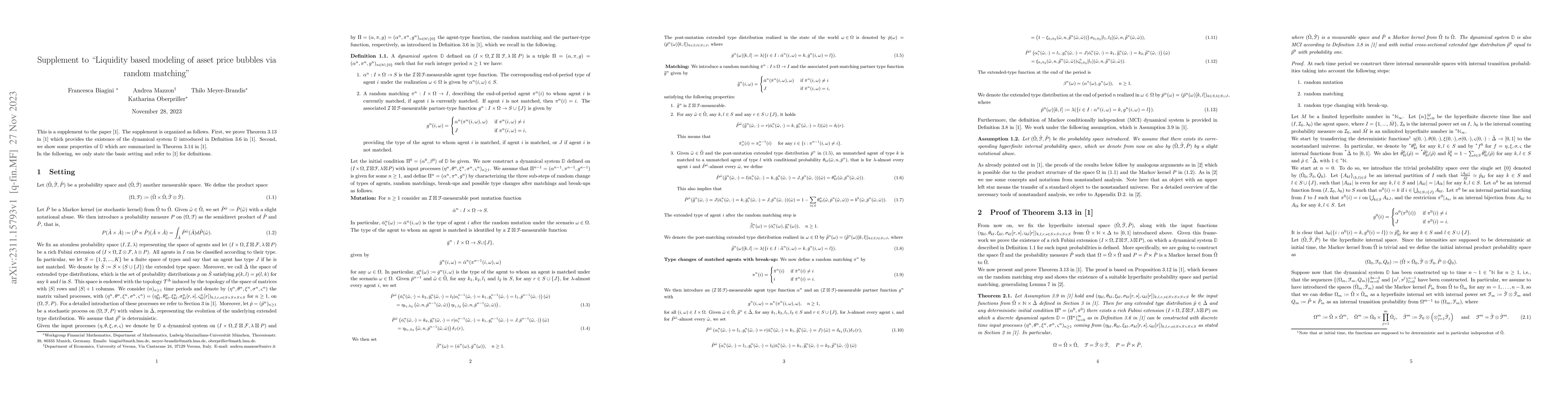

This is a supplement to the paper "Liquidity based modeling of asset price bubbles via random matching". The supplement is organized as follows. First, we prove Theorem 3.13 in [1] which provides the existence of the dynamical system D introduced in Definition 3.6 in [1]. Second, we show some properties of D which are summarized in Theorem 3.14 in [1]. In the following, we only state the basic setting and refer to [1] for definitions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity based modeling of asset price bubbles via random matching

Francesca Biagini, Andrea Mazzon, Thilo Meyer-Brandis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)