Authors

Summary

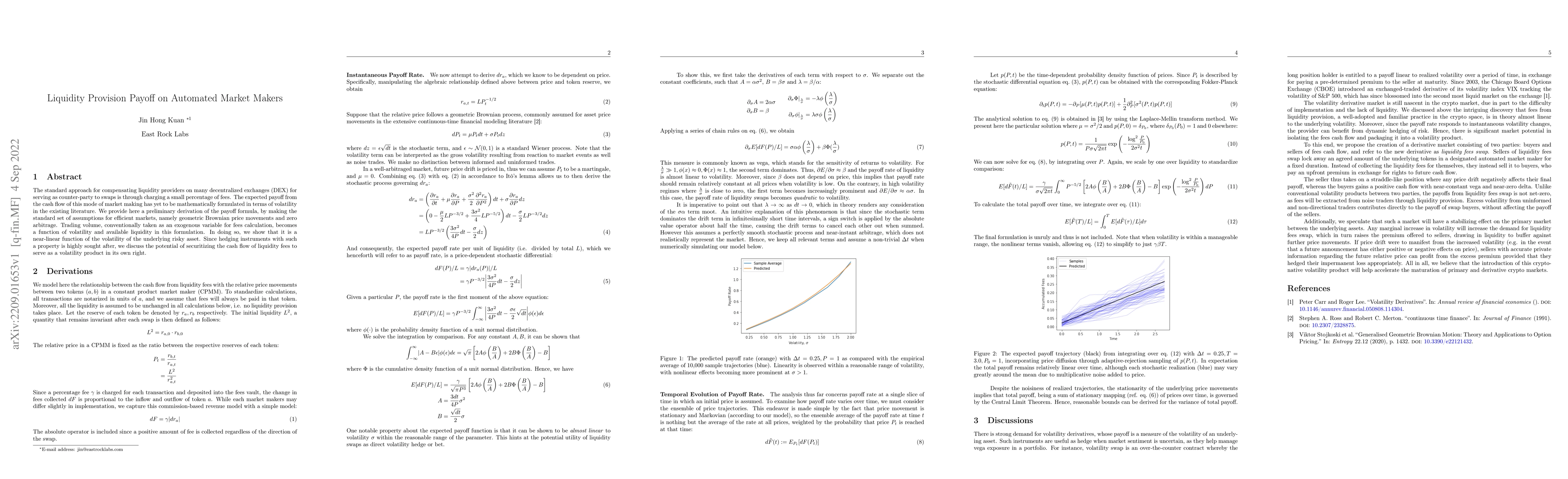

The standard approach for compensating liquidity providers on many decentralized exchanges (DEX) for serving as counter-party to swaps is through charging a small percentage of fees. The expected payoff from the cash flow of this mode of market making has yet to be mathematically formulated in terms of volatility in the existing literature. We provide here a preliminary derivation of the payoff formula, by making the standard set of assumptions for efficient markets, namely geometric Brownian price movements and zero arbitrage. Trading volume, conventionally taken as an exogenous variable for fees calculation, becomes a function of volatility and available liquidity in this formulation. In doing so, we show that it is a near-linear function of the volatility of the underlying risky asset. Since hedging instruments with such a property are highly sought after, we discuss the potential of securitizing the cash flow of liquidity fees to serve as a volatility product in its own right.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity Pool Design on Automated Market Makers

Chen Yang, Xue Dong He, Yutian Zhou

Delta Hedging Liquidity Positions on Automated Market Makers

Xi Chen, Adam Khakhar

The Cost of Permissionless Liquidity Provision in Automated Market Makers

Julian Ma, Davide Crapis

| Title | Authors | Year | Actions |

|---|

Comments (0)