Summary

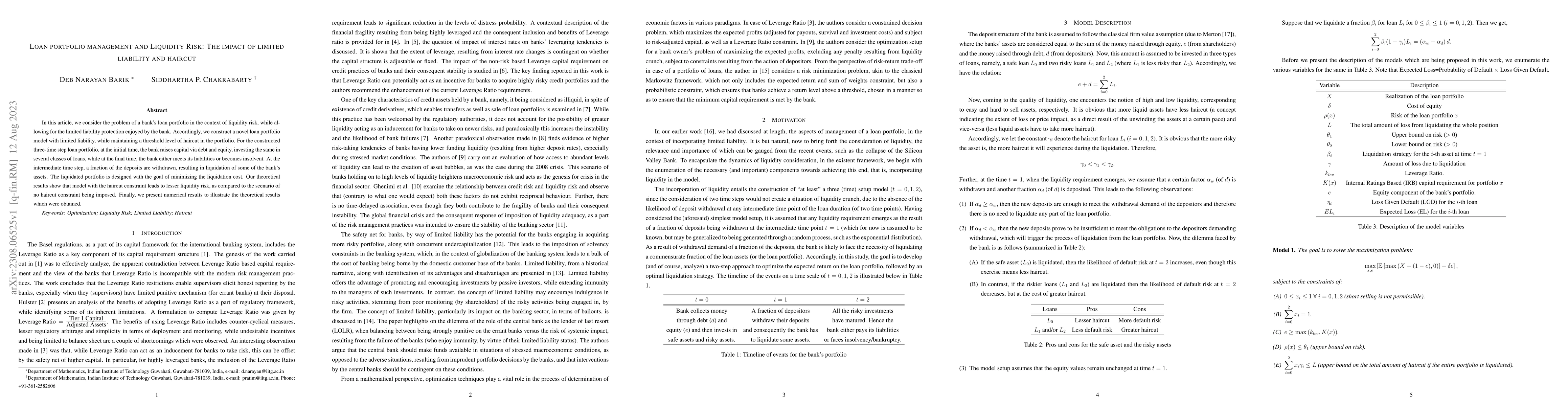

In this article, we consider the problem of a bank's loan portfolio in the context of liquidity risk, while allowing for the limited liability protection enjoyed by the bank. Accordingly, we construct a novel loan portfolio model with limited liability, while maintaining a threshold level of haircut in the portfolio. For the constructed three-time step loan portfolio, at the initial time, the bank raises capital via debt and equity, investing the same in several classes of loans, while at the final time, the bank either meets its liabilities or becomes insolvent. At the intermediate time step, a fraction of the deposits are withdrawn, resulting in liquidation of some of the bank's assets. The liquidated portfolio is designed with the goal of minimizing the liquidation cost. Our theoretical results show that model with the haircut constraint leads to lesser liquidity risk, as compared to the scenario of no haircut constraint being imposed. Finally, we present numerical results to illustrate the theoretical results which were obtained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDoes limited liability reduce leveraged risk?: The case of loan portfolio management

Siddhartha P. Chakrabarty, Deb Narayan Barik

No citations found for this paper.

Comments (0)